Amazon-backed Rivian Automotive, is targeting a valuation of more than $53 billion for its US debut, placing this electric vehicle maker in the same league as rival, Honda Motors, as EV companies emerge as some of the most sought after investments, in the wake of Tesla.

Rivian is currently building electric delivery vans for Amazon while simultaneously developing an electric pickup and SUV range.

The startup is looking to raise as much as $8.4 billion, placing it as the third-largest initial public offering (IPO) by funds raised in the past ten years in the US.

Only three other companies have raised more than $8 billion while going public since 2011, according to data from Dealogic.

This funding, if achieved, will place Rivian in the top-three IPO valuations – on the same table as Alibaba ($25 billion, 2014), Meta Platforms Inc. ($16 billion, 2012), and Uber ($8.1 billion, 2019).

Ford holds a more than 5% share in Rivian and Amazon, which unveiled that it held a 20% stake in Rivian at the end of October this year, has ordered 100k of its electric delivery vans as part of the company’s ongoing efforts to cut its carbon emissions.

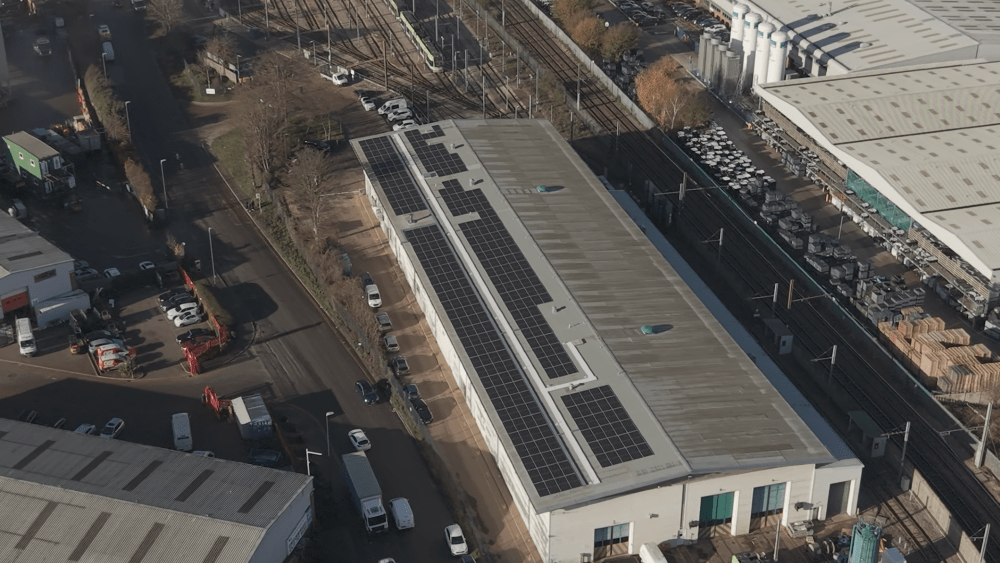

Image: courtesy Rivian newsroom