Fresh vehicle sales figures have revealed battery electric vehicles (BEVs) saw a sizeable increase in January, up 41.6% to 29,634 units, delivering a market share of 21.3%.

In addition, plug-in hybrid (PHEVs) registrations also rose by 9.0% to 12,598 units, and hybrids (HEVs) by 2.9% to 18,413 units.

BEV uptake has now grown by 20.9% to 462,000 – a 23.7% market share, which is short of the mandated 28% target for this year, but above the 22% for 2024, and still growing across an annual period.

Figures from the Society of Motor manufacturers and Traders (SMMT) also showed a decline in ICE vehicles, which made up around 50% of registrations. It also said the review of the Vehicle Emissions Trading Scheme and its flexibilities is “essential” and “must deliver meaningful changes urgently”.

Other data from New Automotive (based on DVLA registrations) revealed petrol and diesel sales continued to decline, falling from 50% to 38% last month.

Concern has risen around the Expensive Car Supplement (ECS), which has remained at £40,000.

The SMMT said that with more than twice as many BEVs registered this January than in the whole of 2017, raising the eligibility threshold for EVs – or exempting them from the ECS entirely – would “send the message that EVs are essentials, not luxuries, and ensure vehicle taxation remains fair and appropriate for today’s market conditions”, it said.

Mike Hawes, SMMT Chief Executive, said:

“January’s figures show EV demand is growing – but not fast enough to deliver on current ambitions. Affordability remains a major barrier to uptake, hence the need for compelling measures to boost demand, and not just from manufacturers.

“The application, therefore, of the ‘Expensive Car Supplement’ to VED on electric vehicles is the wrong measure at the wrong time. Rather than penalising EV buyers, we should be taking every step to encourage more drivers to make the switch, helping meet government, industry and societal climate change goals.”

Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), said:

“Fleet and private demand continue to see declines. Conversely, BEVs have seen a strong start, taking more than a fifth of new car registrations. It is important to highlight that the ZEV mandate quota for new cars will increase to 28% this year.

“In NFDA’s 2025 Outlook Survey, dealers were concerned with the outlook for 2025, with 71% selecting ‘pessimistic’ in response to how they view the overall trading environment for the year ahead, while 29% were ‘slightly optimistic.’

“Also in the survey, dealers highlighted the need for government support, including incentives such as grants and investments in charging infrastructure. They also stressed the continued benefits of hybrids beyond 2030. These will be highlighted in NFDA’s response to the phase-out date/ZEV mandate consultation this month.

“2025 is expected to bring notable changes for automotive dealers, including an increase in Employers’ National Insurance contributions from 13.8% to 15% and the introduction of Vehicle Excise Duty on electric vehicles. The UK automotive sector is a vital sector in the UK and historically NFDA members have been very flexible and resilient to headwinds.”

Vicky Edmonds, CEO of EVA England, said:

“Great to see new EV sales record their best ever start to the year, a month on from seeing not a single carmaker face fines from the first ZEV Mandate target for 2024.

“The sector is working hard to tackle remaining barriers to uptake such as high upfront and public charging costs, and it’s great to see drivers respond with added confidence in EV”

Vicky Read, CEO of ChargeUK, said:

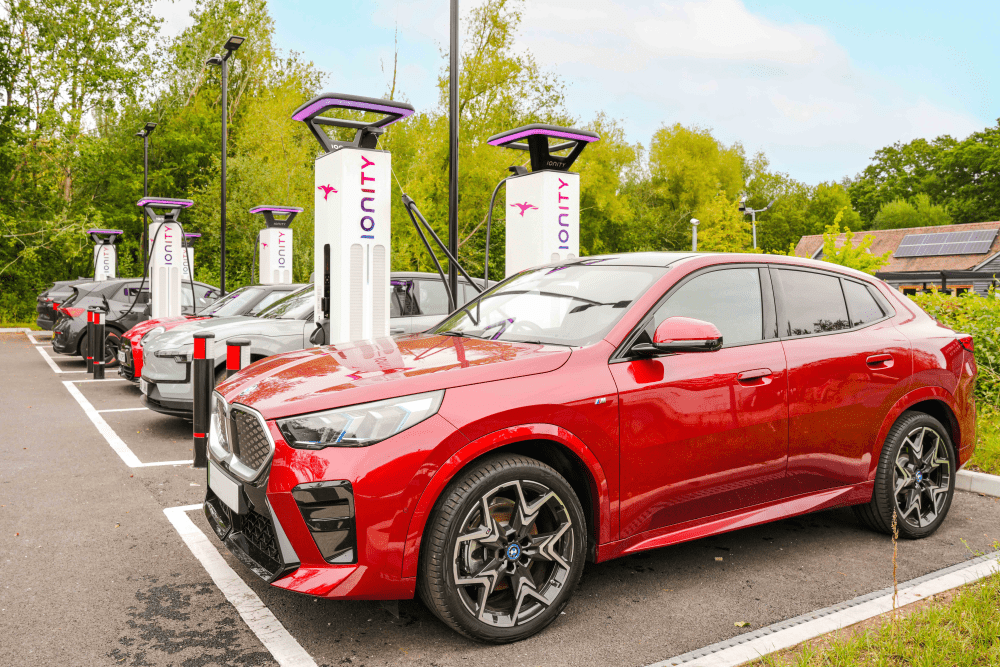

“January’s EV sales figures demonstrate once again there is strong and growing demand for these vehicles, as we drive towards an electric future.

“With now close to 75,000 public chargers and thousands more installed every month, ChargeUK members are already investing billions to ensure that charging is installed ahead of demand for the millions of drivers that will make the switch in the coming years.

“But to be able to deliver the widespread, affordable charging that car manufacturers need in place, so that they can sell EVs, the charging sector needs a strong and stable policy framework. That means sticking to the ZEV mandate and creating additional incentives to help even more drivers switch.

“The alternative – changing the goal posts through a weakened mandate – will see the UK spiral into a vicious circle of reduced infrastructure investment, fewer, more expensive chargers and lower demand for EVs.”

Image from Shutterstock