Iberdrola has signed an agreement to acquire 88% of Electricity North West (ENW) in the UK for an equity value of £2.1 billion (€2.5 billion).

The deal, which values the company at €5 billion, follows Iberdrola’s strategy to invest in electricity networks and in countries with a strong credit rating, such as the United Kingdom (AA credit rating).

Since the merger with ScottishPower in 2007, the UK has been one of the leading investment destinations for the company, where it has invested around £30 billion (€36 billion). ScottishPower is the only 100% green integrated utility in the UK.

With the completion of the deal, the UK becomes Iberdrola’s leading market by regulated asset base, which is valued at approximately €14 billion.

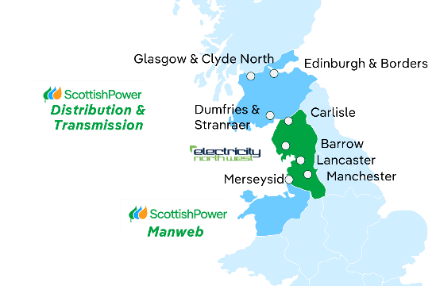

ENW is located between the two existing ScottishPower networks license areas, in central and southern Scotland and Merseyside and North Wales.

Iberdrola will now distribute electricity to around 12 million people in the UK, across a network which will span more than 170,000 kilometers. In addition, Iberdrola will employ more than 8,500 people in the country.

Currently, Iberdrola operates more than 111,400 km of installed power lines in the country, with 40 onshore wind farms and two offshore wind farms in operation.

Ignacio Galán, Iberdrola’s executive chairman, said:

“This transaction reinforces our commitment to investing significantly in electricity networks, which are a critical component for supporting the electrification and decarbonization of the economy. The agreement is also consistent with our strategy to invest in countries that have ambitious investment plans and stable and predictable regulations.

As a result of this acquisition, our regulated networks asset base in the UK is now valued at €14 billion. When combined with the US, these two markets now represent two-thirds of our total global regulated asset base.”

Image of distribution courtesy of Iberdrola