Lash Saranna, Co-founder and CEO of EZOO, highlights the challenges and opportunities which are being brought about by the rising cost of insurance and the impact this is having on uptake of electric vehicles (EVs).

The insurance industry in the UK is overdue a complete overhaul, it is an industry that is reactive rather than proactive, similar to the traditional automotive industry who are now on the verge of being washed away by the upcoming tsunami of Chinese OEMs entering the UK market.

The insurance industry appears to take direct aim at EVs being responsible for the rise in the cost of premiums, citing EV repairs being more expensive than traditional internal combustion engine (ICE) cars, yet the facts highlight the theft of ICE cars, particularly Range Rovers, young drivers involved in accidents, expensive parts such as catalytic convertors being stolen by thieves from cars attribute to more claims than the number of accident damaged EVs.

As a direct result of these misaligned reports of EVs being expensive to repair, the scaremongering is leading to consumers being further led astray by traditional car dealers who push ICE car sales rather than highlighting the benefits of zero emission electric cars.

This will partly be addressed by the Chinese OEMs who will bring lower priced EVs to the market which will be in direct price comparisons to ICE models hence, making the ownership of EVs much cheaper than ICE cars.

Meanwhile, the insurance industry must go back to the start to reimagine the present and the future with fresh thinking to align its offering with today’s consumers and their requirements. Flexibility will be key, they need to step out of the 20th Century and get into a world where consumer requirements, digital operation, speed of action, and flexibility are all entwined with being proactive and on the front foot.

The biggest drain on resources and hence the root cause of the policy cost can be attributed to three key elements:

- Time taken to settle claims, the use of OEM vehicle data to determine accident fault would decrease the time taken to settle claims, as well as after-market telematics including cameras

- On Street Connected Data centres, the UK has one the world’s best surveillance systems which are connected in every way from traffic light automation to CCTV on virtually every corner

- First Notice of Incident/Accident reporting, this could be stipulated in the policy and failure to report with a given time would lead to failure of the claim.

The above would allow the insurance industry to move into the 21st Century and be in the same space as today’s consumers and businesses. Failure to move into the same space will become the failure of the industry, instead it must look to the future and remodel itself to not only survive but thrive!

All of the above can be tied into the Environment and Climate Change Committee paper issued recently House of Lords – EV strategy: rapid recharge needed – Environment and Climate Change Committee (parliament.uk).

This lengthy paper highlights that the progress is not happening fast enough in part due to the misinformation in the market about EVs and the anxiety that consumers face as a result of that including in respect of safety, reliability and affordability.

The committee have called for the Government to do more and do it more quickly, which puts the onus back on the private sector, one of which is the insurance industry who should take the bull by the horns and push forward with decisive action. The first should be to digitise insurance policy allowing customers to report accidents via their mobile phones. Every policy should have a digital link that the customer could have in their phone as a contact allowing them to call, text or email and send images of an accident.

This one action alone would have a tremendous effect for the insurance sector and would have a chain reaction as follows:

- Make the customer interactive in the accident claim process rather than being a by-stander and completing endless forms and statements

- This would speed up the process for claims for the insurer

- Reduce the time to settle claims.

In turn these actions would reduce the cost of premiums.

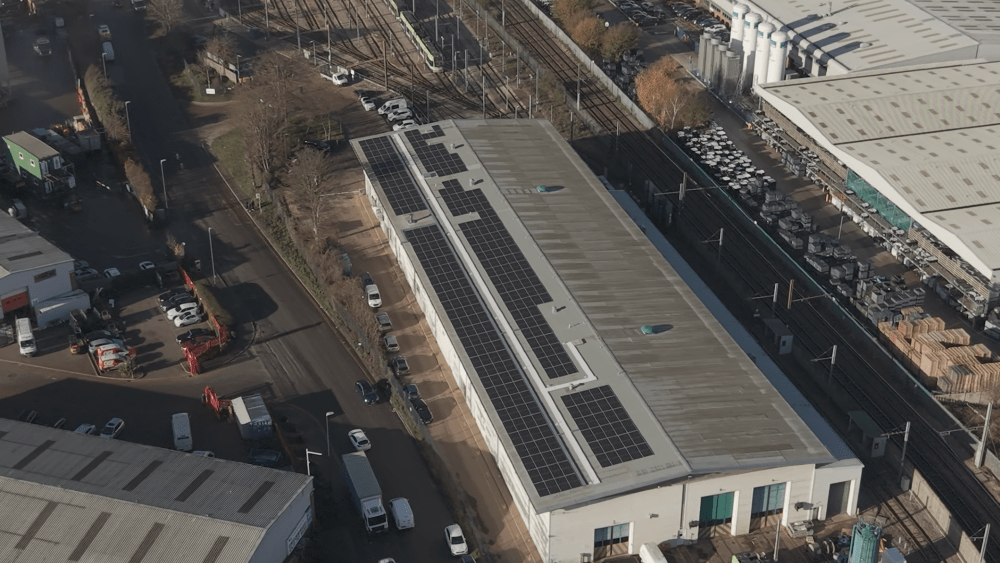

Images courtesy of EZOO.