A new report from Energy UK details measures introduced recently by the United States and the European Union, as well as other countries like China, Japan and India, in order to incentivise investment in clean energy.

Published on the first anniversary of the Inflation Reduction Act (IRA), the report highlights what the US and other major economies are doing to attract investment in clean technologies, leading to calls for the UK to respond in kind.

Funding The Future is the latest report in Energy UK’s Clean Growth Gap series produced in partnership with Oxford Economics.

The IRA, for example, has a total budget of $369 billion for the period 2023-2031 with the majority of this funding in the form of tax credits to reward private investment in clean technology, transport and manufacturing. Although many of its provisions only become effective at the start of the year, early indicators featured in the report point to the impact these are already having. Funding announced for new factories in the automotive and battery sectors since the IRA was passed is more than 20 times higher than it was in 2021 while share prices for US based companies specializing in low-carbon technology have also been boosted.

The EU responded to the IRA with its Green Deal Industrial Plan (albeit with a wider scope than the IRA) incorporating funding from two existing programmes – Repower EU (€270bn) and the Recovery and Resilience Fund (€250bn) – with support also available through other initiatives, along with the relaxation of State Aid rules and other regulatory requirements.

The report also details how China, whose $546 billion spend amounted to near half of the world’s clean technology investments in 2022, has unveiled a $72.3 billion packages of tax breaks for electric vehicles. Japan already has a $18 billion Green Innovation Fund in place and aims to realise $1 trillion in public-private investment to finance its green transition over the next 10 years, while the Indian Government has this year promised to make $4.3 billion in investments towards its own transition.

Such measures have increased the calls for the UK to respond to this challenge or risk losing its world-leading position in clean energy. Although the UK is currently a dominant player in offshore wind and is the only economy out of the world’s eight largest to produce more electric and hybrid vehicles than traditional cars, it is also forecast to have the slowest growth in low-carbon electricity generation of these economies between now and the end of the decade. Low levels of expected investment are a significant factor in this forecast with the UK performing below most other OCED nations when it comes to incentives for investment.

Energy UK’s Chief Executive Emma Pinchbeck said: “The IRA has been a game changer for the investment landscape and as this report shows, other key markets are already responding. The UK’s world-leading role in the development of clean energy has given us strengths in terms of expertise and experience – but we have no divine right to this position.

“With growing global competition for private investment that can choose its location, a failure to respond will quickly see us fall behind and jeopardise ambitious targets for increasing our own sources of clean energy and decarbonising our whole economy. While we can’t necessarily replicate what the US has done, resting on our laurels and missing out on the economic boost such investment offers our country would be a very serious mistake.”

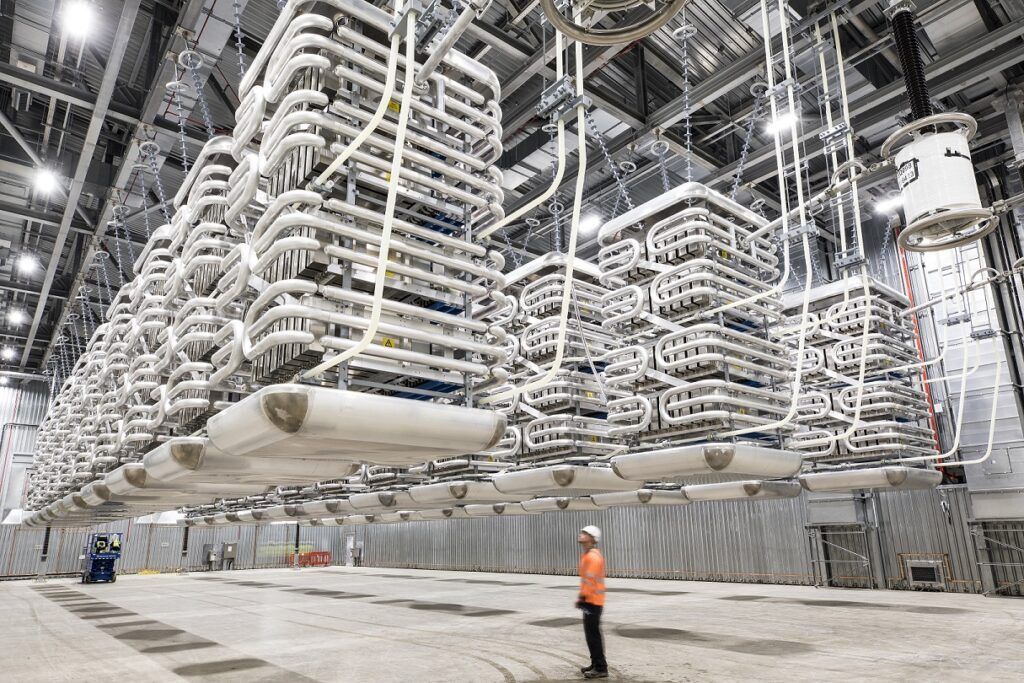

Image courtesy of Shutterstock.