European fast‑charging company Fastned has secured up to €200 million in new green financing from ABN AMRO, CreditAgricole, ING, Invest-NL and Rabobank to accelerate the expansion of its network of fast charging stations across Europe.

The new green loan facility consists of an initial €100 million of committed capital will fund station rollout in Belgium and Switzerland over the next three years.

In addition, there is an uncommitted accordion option of an extra €100 million for expansion to other countries. The facility will support the rollout of Fastned stations, expansions and capacity upgrades to existing locations and the acquisition of new locations for development.

The facility marks the start of a funding platform to support the company’s growth ambitions in 2026 and beyond, the firm said.

The facility represents a third pillar of financing for Fastned, alongside its ongoing retail bond programme and its equity listing on Euronext Amsterdam.

Since its founding in 2012, Fastned has raised over €740 million in total funding including retail bonds, making it one of the best-funded charging companies in Europe, it claimed.

Fastned’s network now extends to more than 400 charging stations across nine European countries, with charging-related revenue growth of over 40% year-on-year. Fastned’s recent Q4 Update reported 54.8 GWh of energy sold across more than 2 million charging sessions in Q4 2025; new records for the company, alongside the all-time quarterly high in revenue related to charging.

Victor van Dijk, CFO of Fastned, said:

“I am very excited that we’ve now added an important third funding pillar to finance the growth of our network. The equity platform and the retail bond programme have each raised over 250 million euro in growth capital to date, and this new bank funding platform will allow for amounts beyond that.

“Bank financing is a multi-billion euro market with dozens of banks active across Europe, meaning the size potential of this programme is more than sufficient to meet Fastned’s needs for years to come.”

Tom Hurst, Fastned UK Country Director, said:

“It’s incredibly energising to see leading banks commit up to €200 million in financing for Fastned. It marks a defining moment for the company and a powerful endorsement of its strategy, giving us a real boost and creating scalable funding that can grow with Fastned as we expand internationally, supporting our ambitions to build 1,000 stations by 2030. This further strengthens our position as one of Europe’s leading ultra‑rapid charging companies.

“I’m hugely proud of what we have achieved to reach this point and excited about where we are going. Our focus in the UK for 2026 is simple and unwavering. We’re not just rolling out ultra‑rapid EV charging stations; we’re helping shape the future of UK EV adoption.

“By making charging reliable, intuitive and genuinely enjoyable and continuing to put drivers at the heart of everything we do, from our iconic yellow solar canopies to ultra-rapid chargers in premium locations. Our expanding network will one day enable EV drivers to access charging wherever and whenever they need it, helping to power the UK’s transition to fair and accessible zero‑emission mobility.”

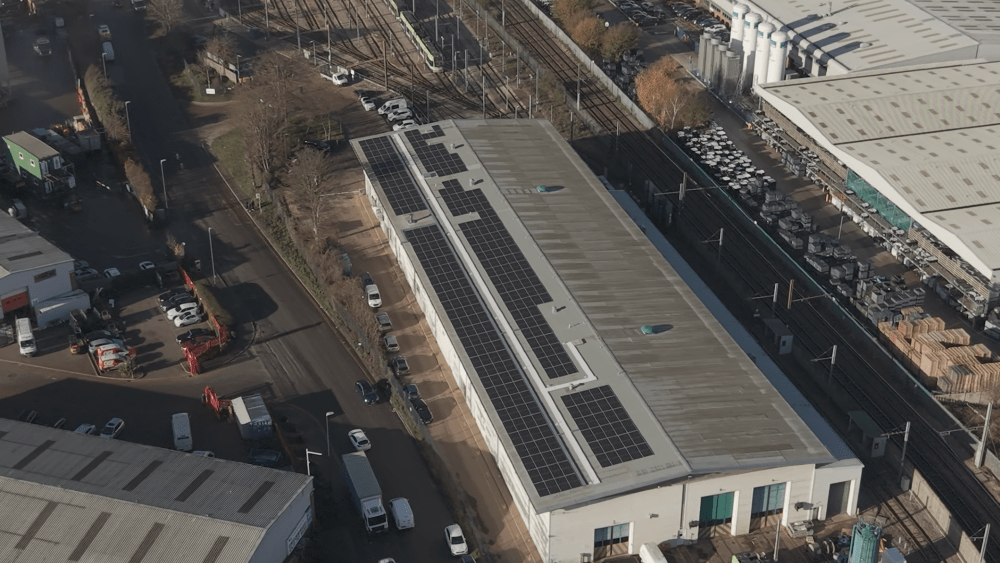

Image courtesy of Fastned