Reduced government incentives aimed at supporting motorists purchasing electric vehicles have stalled the UK’s progress in switching to EVs.

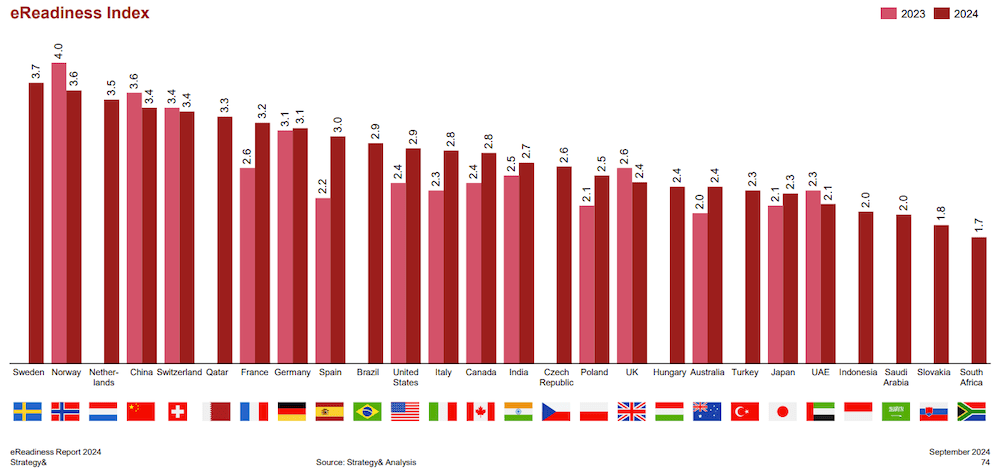

PwC’s latest eReadiness survey ranked the UK 11 out of 13 European countries in its ability to facilitate a full move to EVs, with an overall rating of 2.4 out of a possible 5.0. The UK is ranked 17 globally out of a total sample size of 26 countries.

The UK has lost ground in its overall e-Readiness against 2023 level (-0.2 vs 2023), driven by a decrease in Government incentives (-1.0 since 2023). Demand for EVs was shown to be increasing slowly in the UK, with this metric increasing by 0.3 to 3.3.

The UK’s e-Readiness relative to other European nations has weakened since 2023, where it sat joint-fourth. Its weakened position is also driven by new European entries in this year’s study, particularly Sweden and the Netherlands, who are seen as leaders in EV adoption and the readiness space. Spain, France, and Italy have also seen increases in their e-Readiness since 2023.

But the overall satisfaction level among current UK EV owners remained high, up 10% YOY, with approximately 96% expressing satisfaction with their EVs (vs 93% at a global level). The main contributing factors included a better battery lifetime (57%), recharging time (50%) and driving range (41%).

Amongst UK EV owners, 70% said they would not switch back to a combustion engine. Dissatisfaction with EVs amongst this UK cohort is driven by higher than expected maintenance costs and concerns about range limitations.

Amongst UK prospects, who indicated an intention to buy an EV within the next five years, the key elements to consider switching were fuel economy (61%), the convenience of recharging at home (44%), as well as the reduced environmental impact (28%) and driving range (39%).

Price (65%) was an important criteria when purchasing a new EV among UK prospects, alongside safety (50%) and battery range (44%). In terms of overall EV package, charging solution (54% vs 64% at global level) and duration of warranty (48% vs 52% at global level) were the most important criteria for UK Prospects.

Concerns around limited range decreased 7% compared with 2023’s findings, indicating a reduction in range anxiety amongst prospective owners.

Antoinette K Meehan, Director in PwC UK’s Automotive Practice, said:

“The UK’s drop in its eReadiness signals the need for a reassessment of both consumer and Government roles in driving mass EV adoption. While automotive brands and dealers have a significant role to play in strengthening their brand position and building trust, especially in the UK, effective collaboration between Government, manufacturers and infrastructure providers is essential.

“Recognising that the experience of buying, owning and driving an electric vehicle is significantly different to that of combustion engine vehicles, means creating the right economic and environmental factors that will foster confident, mass-market ownership.”

Cara Haffey, PwC UK’s Leader of Industry for Industrials and Services, added:

“Strategic collaboration between automotive manufacturers, Government and infrastructure providers is needed more than ever for a seamless transition to electric vehicles.

“Educating and engaging consumers is also going to be very important. Automotive brands, dealers, and the Government must collaborate to highlight the long-term benefits of EVs and create engaging experiences to dispel misconceptions. We welcome the Government’s fast-track review into the situation, and by taking key steps, the UK can still be a leader in the global EV revolution.”

Image from Shutterstock