Electric vehicle manufacturer BYD has showcased its Flash charging technology in China, ahead of a global rollout of the technology.

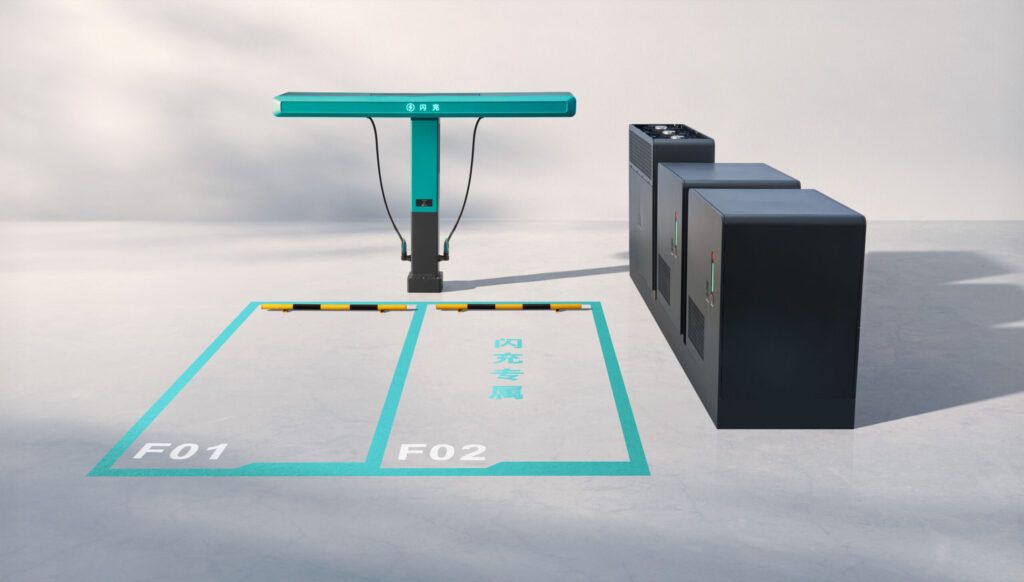

The company showed the charging technology, which delivers up to 1500kW through a single connector, alongside the second generation of its Blade Battery.

It follows the company originally announcing the technology a year ago, which highlighted how it could result in charging speeds similar to refuelling a traditional internal combustion engine vehicle.

When combined, the two new technologies deliver recharging speeds of a 10% to 70% refill in as little as five minutes, while 10% to 97% requires only nine minutes.

It also announced that the first vehicle to reach European customers will be the DENZA Z9GT with final specifications of the European version of the car “will be issued in the coming weeks”, it said.

In addition, the firm said it was “committed” to making the Flash charging station available globally, with more details on an overseas rollout “communicated in due course”.

BYD has already installed 4,239 Flash Charging stations across China, and it expects to have 20,000 in operation by the end of this year.

The new technologies are the result of “intensive development” by BYD, it said, following extensive research into the barriers consumers still feel are present between them and pure-electric mobility.

Wang Chuanfu, Chairman and President of BYD, said the industry “needs to address the lingering challenge of slow charging speeds and poor low-temperature charging performance if the remaining consumers are to commit to electric mobility”.

The new technology from BYD aims to overcome these concerns, and features a ‘Flash-Release’ cathode with a directionally engineered, multi-level particle-size architecture that enables dense packing and rapid deintercalation. In addition, a ‘Flash-Flow’ electrolyte uses AI-driven precision optimisation to deliver high ionic conductivity and fast ion mobility, while the ‘Flash-Intercalate’ anode has a multi-dimensional lithium-insertion site construction, allowing 360° 3D high-speed lithium-ion intercalation.

Together, these technologies mean significantly reduced internal resistance, cutting heat generation at the source, it said.

Image courtesy of BYD