Figures released by the Society of Motor Manufacturers and Traders (SMMT) show that the UK maintained its place as Europe’s second largest zero emission truck market with uptake of new heavy goods vehicle (HGVs) rising by 30% in Q2 2024 to achieve a 0.6% share of market, up from 0.4% in Q2 last year.

However, market share remains low compared with the car and van sectors, demonstrating the ongoing challenge in convincing operators to switch from fossil fuels.

With just over a decade to go until the end of sale of non-ZEV HGVs weighing less than 26 tonnes, operators continue to face a grant system that is lengthy and covers fewer than half of all available models. Progress on the rollout of HGV-specific charging facilities also remains lacklustre, according to the SMMT. Reforming the grant, plus investment in infrastructure within a national plan, would provide more confidence to operators and encourage greater uptake, the SMMT says.

Mike Hawes, SMMT Chief Executive, said:

“The truck market’s return to growth after a slower start to the year demonstrates its robustness and resilience – particularly as overall uptake continues to keep pace with last year and the pent-up demand that fuelled volumes. The UK’s place as Europe’s second largest zero emission truck market also demonstrates Britain’s potential to be a leader in the ZEV truck transition. Delivering that ambition, however, requires compelling incentives and infrastructure which will put operators on a confident path to 2035 and beyond.”

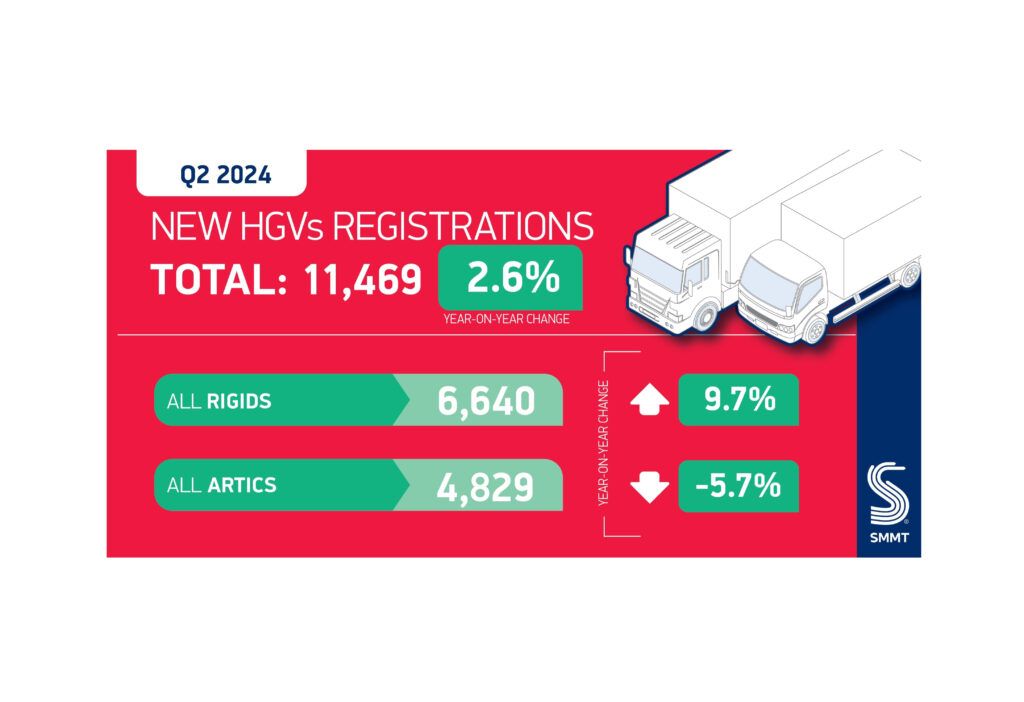

Overall, new heavy goods vehicle (HGV) registrations rose 2.6% in Q2 2024, reversing the decline recorded in the first quarter of the year.

Spring saw 11,469 new HGVs enter service, with growth driven by a rise in rigid truck uptake as the market continues to normalise following the fulfilment of pent-up demand in 2023. Rigids rose 9.7% in Q2 to reach 6,640 units, taking a 57.9% market share, up from 54.2% in the same quarter last year. Conversely, artic volumes declined by -5.7% to 4,829 units.

The weighting of the market towards rigids was reflected in the composition of the top body types, with businesses investing more in box vans (up 17.3%), curtainsiders (up 14.9%), tippers (up 11.4%) and refuse vehicles (up 14.1%), while tractor unit volumes fell -7.4%.

Nationally, England took the lion’s share of new HGV registrations, with volumes rising 1.6% to reach 9,827 units. Northern Ireland recorded the largest growth, up by 30.6%, which saw it overtake Wales to become the UK’s third largest HGV market.

Graphic courtesy of SMMT.