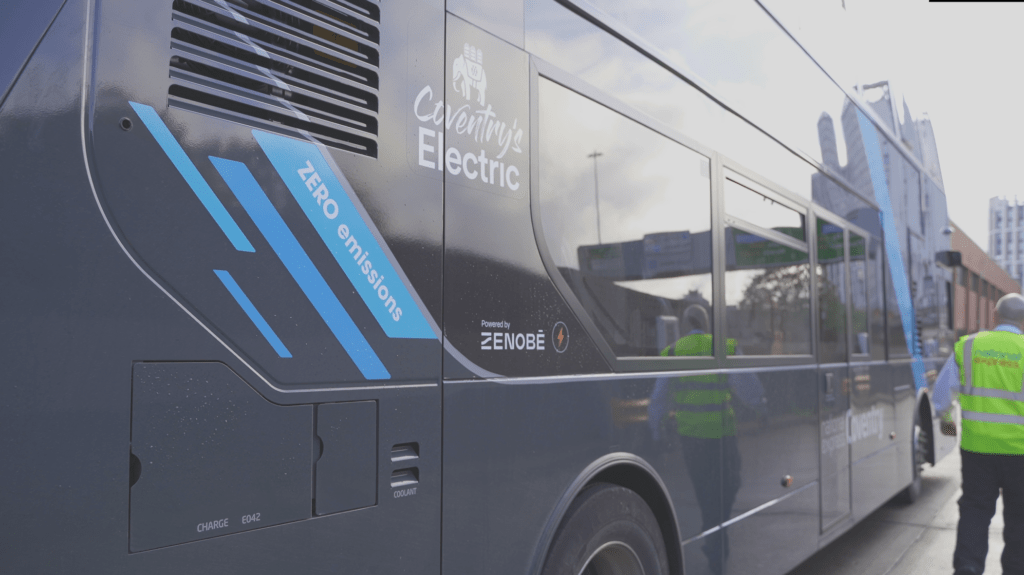

Zenobē – a leader in electric vehicle fleet services and battery storage innovation – has secured a further £410 million in financing to speed up its support for the rollout of electric buses with over 2,000 e-buses expected to be deployed throughout the UK and Ireland by 2026.

The announcement, in addition to its existing £241m financing platform established in 2022, marks over £1 billion of green debt funding raised by Zenobē since 2019.

The substantial financing promises to reshape the UK’s urban mobility landscape, offering tailored financial solutions to support bus operators to deliver more than 2,000 new electric buses throughout the UK and Ireland by 2026. One solution is Zenobē’s battery management service that removes battery risk for operators by taking on the responsibility and risk associated with EV batteries, including battery performance, replacement and repurposing in second-life applications – an area which Zenobē is pioneering.

In Yorkshire, the fleet electrification specialist is working with Transdev Blazefield to finance 39 fully electric vehicles in its Harrogate depot, including a 15-year battery management service. Earlier this year, Zenobē also announced the financing of 24 batteries on board Nottingham City Transport’s newly acquired fleet of fully electric single deck buses. Both projects utilised Zenobē’s financing structures to enhance their Zero Emission Bus Regional Areas (ZEBRA) allocations. Zenobē’s services are designed to remove the financial and operational barriers to fleet electrification and reduce ongoing costs. This funding will empower more operators to provide greener, cleaner and more efficient service offerings to their customers.

Underpinning the announcement is the recognition of sustainable transport as a bankable asset class, with Zenobē establishing itself as a key enabler for the bus and fleet industry’s transformation. Through strategic partnerships with major financial institutions, Zenobē has assembled a network of 13 lenders committed to supporting the expansion of green public transport including Aviva, Lloyds, MUFG, NatWest, Santander, Scottish Widows, Siemens Financial Services through Siemens Bank and Société Générale. New banks and institutions to join the syndicate include ABN AMRO, CIBC, NAB, Rabobank and SMBC Group.

This collaborative investment will allow bus operators to benefit from Zenobē’s advanced support structures and strong track record supporting over 75 electric depots to date. According to the company, It will expedite the smooth transition to green transport whilst enabling operators to meet growing environmental regulations, as well as the needs of communities across the country.

Steven Meersman, Founder and Director, Zenobē said:

“This is more than a story of Zenobē’s growth; it is a leap forward for the bus industry in the UK. This expansion of our existing financing will help us continue our work with operators across the UK with specialist solutions to one of the biggest barriers to electric fleets – the upfront cost. By gaining both new and renewed support from the right financial partners we are taking another step forward in our mission to electrify the UK’s buses at scale, reducing carbon emissions and connecting more communities in the UK.”

Joe Taylor, Head of Infrastructure, Project and Asset Finance at NatWest, said:

“This transaction represents the natural next phase in the evolution of the E-bus funding platform for Zenobē. The platform was designed to accommodate multiple sources of debt, and this has been achieved via the new facilities that Zenobē has entered into with commercial banks (both existing and new) and institutional funders. The proceeds of this new financing will support Zenobē to drive the decarbonisation of the UK Public Transport system.”

Darryl Murphy, Managing Director, Infrastructure, at Aviva Investors, said:

“As one of the largest investors in UK real estate and infrastructure, we understand the important role of private capital in developing its national infrastructure, particularly projects which support the decarbonisation of transport networks. Although the market for battery electric buses has developed rapidly into a leading zero emission technology, there is an undersupply of E-buses nationally. As such, we are pleased to have completed this financing which will help Zenobē continue its roll-out of EV buses, whilst also complementing the UK’s own zero emission schemes and delivering investment returns to UK retirement savers.”

This substantial funding highlights the momentum behind the shift towards EV buses and the commitment from operators to align with the latest clean air benchmarks and the national net- zero ambition.

Image courtesy of Zenobe.