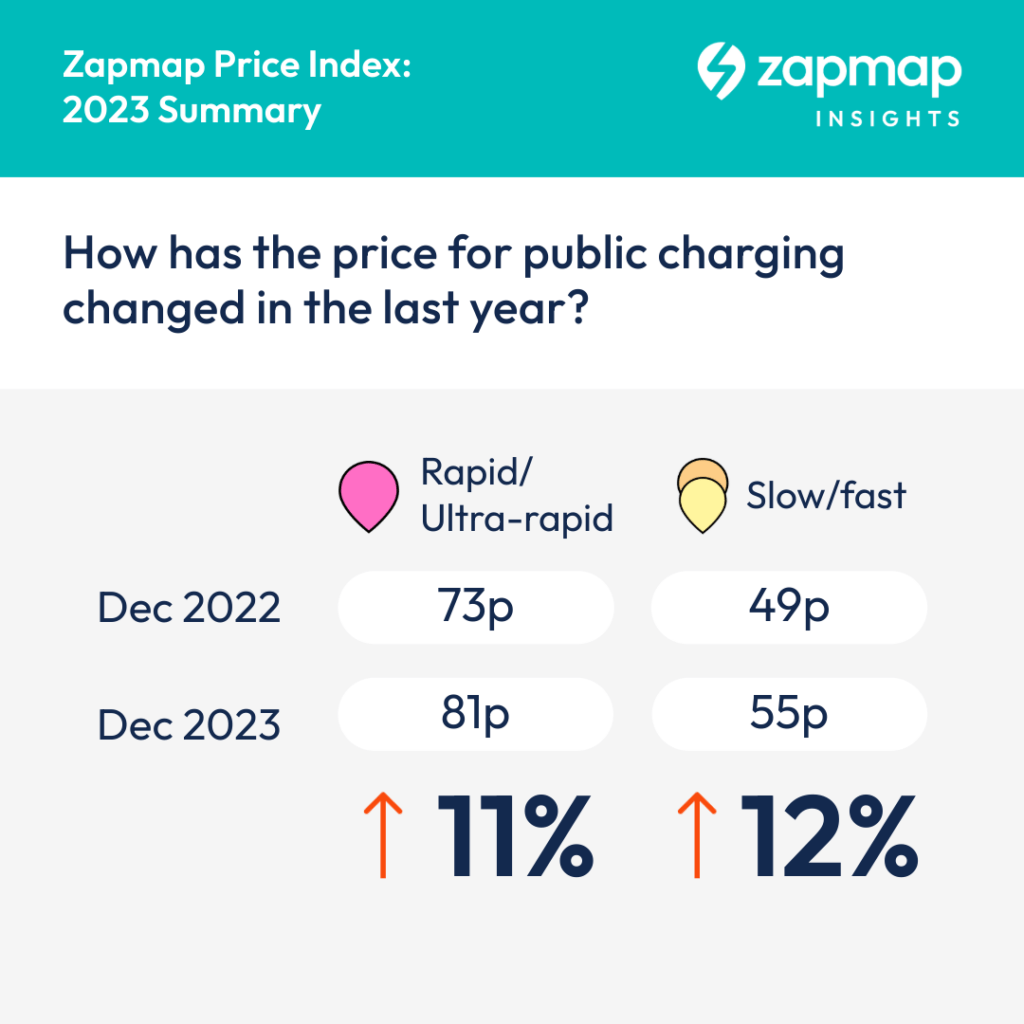

Charge point mapping service Zapmap has published new figures which show how electric car charging prices on the UK’s public network changed during 2023 – with the overall cost of charging on the public network increasing by 11% in the 12-month period.

However, even with these increases in cost across 2023, the figures from the Zapmap Price Index showed that, as of January 2024, electric car drivers are still in a better position in the majority of cases than drivers of petrol and diesel cars who have to fill up at the pumps.

The Zapmap Price Index takes more than a million recorded charging sessions per month and calculates the weighted average cost that an EV driver pays to charge on the public network. The Index takes into account the increases in price by individual charge point operators, as well as where the largest volume of energy consumption occurs.

The figures show that an increase in costs on the rapid/ultra rapid network – where the majority of charging takes place – is driven by two key factors. The first is consolidation. Although many operators held their prices last year, others significantly increased theirs to bring them in line with the rest of the market.

While there was previously quite a difference in pricing levels, the top six rapid/ultra rapid charging networks have now all settled on a price point of 79p per kWh, with InstaVolt on 85p per kWh.

The second factor is the changing mix of charging, with more drivers opting for the faster, but generally more expensive ultra-rapid (100kW+) charge points. Most significantly, the amount of energy transferred each month by ultra-rapid charge points overtook that of rapid charge points, in June 2023.

During December 2022 for instance, rapid charge points delivered almost half (49%) of all kWh delivered in the month, while ultra-rapid charge points delivered 29% of the total. In contrast, December 2023 saw rapid chargers deliver just 32% of all kWh in the month, with ultra-rapid chargers delivering 45% of the total.

The figures show that, although ultra-rapid options are generally more expensive, electric car drivers increasingly used these high-powered devices as their numbers grew in 2023. According to Zapmap, the estimated energy transferred by ultra-rapid charge points increased by nearly 150% over the course of the year, while the number of ultra-rapid devices increased by 112% in the same period.

The consolidation of prices at the new higher level in public charging can be seen in the context of uncertainty in wholesale energy prices – there are no price caps for business – and an increase in the costs of building and operating charge points.

One major factor has been a change to the grid code that means operators are having to absorb standing charges that are, in some cases, 10 times what they were two years ago. In parallel, charge point operators are facing increasing pressure to deliver a good return on investment.

Melanie Shufflebotham, Co-founder & COO at Zapmap, said:

“This year, with the continued uncertainty in wholesale energy prices and other cost pressures, don’t expect prices on the public charging network to come down in the near future.

“However, looking to the future, there are reasons to be positive. There is continued pressure on the government to equalise the VAT levels between domestic and public charging at 5%. FairCharge is campaigning hard on this and the recent recommendations from the House of Lords also state that the government should act on this.

“In addition, the industry is working both to look at the standing charges and to see if they can get electricity within the government’s Renewable Transport Fuel Obligation.

“In the here and now, most electric car drivers continue to experience lower costs than driving an equivalent petrol or diesel car. The Zapmap Price Index, updated monthly, keeps track of the price that electric car drivers pay when out and about, as well as how prices vary across different types of chargers. This helps drivers seek out the cheapest charging options and keep an eye on costs.”

Many EV drivers charge at home for most of their energy needs, with the energy price cap currently sitting at around 28p/kWh, and might also have the option to install solar panels, or take advantage of a lower price off-peak tariff and so reduce the cost of charging their EV further.

According to the Zapmap Price Index, the typical cost per mile in January for a couple who primarily charge their electric car at home (80% of the time) was seven pence per mile. This contrasted with 15 pence per mile for the driver of a typical vehicle with an internal combustion engine.

Other driver profiles showed that the typical cost per mile for a couple who do half their charging at home, 25% on public rapid/ultra-rapid charge points and 25% on slow/fast chargers was 11 pence per mile last month. However, a driver doing 80% of their charging on the public network would see their typical costs sitting at around 18 pence per mile.

There is certainly concern about the price of public charging, with 62% of respondents to Zapmap’s annual charging survey highlighting the high cost of charging on the public network as a problem – up from 41% in 2022. Additionally, only 14% of respondents said they were willing to pay more than 80p per kWh for high-powered charging.

Despite this, the same survey showed that electric car drivers were less likely to actively search for a cheaper refuelling alternative than when driving an internal combustion engine (ICE) car.

In the survey, drivers were asked the question: ‘When driving, do you actively search for locations with the cheapest petrol station/cheapest charge points?’

Of the 3,800 responses, 20% said they ‘Always’ actively search for locations with the cheapest petrol station when driving an ICE car, while only 10% responded ‘Always’ when driving an EV. At the other end of the spectrum, 29% of respondents said they ‘Never’ actively search for locations with the cheapest charge points when driving an EV. This figure dropped to 14% when driving an ICE car.

Jade Edwards, Head of Insights at Zapmap, said:

“We know that 2023 was a very good year for EV charging, with record growth across the board and especially good progress for ultra-rapid infrastructure in the UK.

“So it’s really interesting to see from these figures how EV charging prices changed last year, in line with the more than 100% growth in ultra-rapid devices being installed across the country.

“Although 2023 saw some charge point operators increase their prices to move more in line with the market, the changing mix of public charging options and the shift in use from rapid to ultra-rapid devices is also a contributing factor. This is particularly significant because we know that electric car drivers were less likely to seek out a cheaper alternative to refuel than when driving a petrol or diesel car.”

Quentin Willson, Founder of FairCharge, said:

”Electricity prices should be going down not up. With up to 50% renewables going into the grid power prices should be falling. But because the market is distorted by the wholesale price of electricity being determined by the last unit in the supply chain – usually a gas power plant – kWh prices are more than they should be. FairCharge and the RAC have repeatedly called for gas and electricity prices to be decoupled to help keep consumer energy prices low. This is now urgent to prevent high power prices becoming a serious drag on the economy, consumers and businesses.”

Image courtesy of Zapmap.