Chinese brands are set to capture a sixth of the UK’s electric car market by 2030 as its manufacturers look overseas after conquering their domestic market, Auto Trader’s latest report shows.

Buyers can expect to benefit from a price war in the electric car market this year as manufacturers fight for market share amidst new government mandated targets and new Chinese competitors, according to Auto Trader’s latest (and renamed) Road to 2035 Report.

China has now become the world’s biggest exporter of cars for the first time after overtaking Japan. The Report shows that in the UK, some new entrants have grown considerably in recent years – Tesla was the first and now accounts for 3% of new car sales in the UK and MG’s focus on affordable electric cars has resulted in rapid growth and a 4% share of the market.

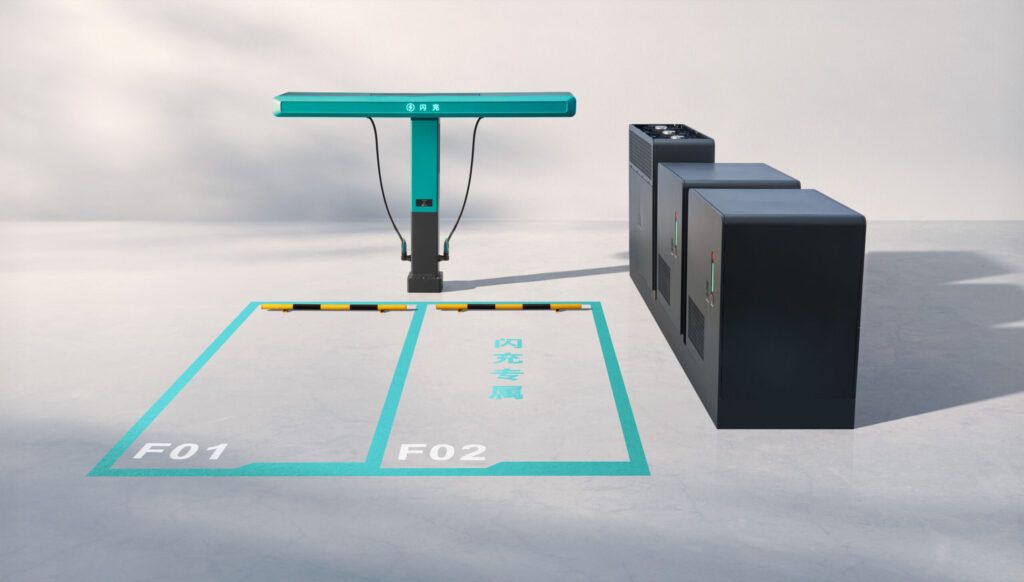

Other Chinese brands, like GWM and BYD, are still establishing themselves – currently accounting for 3% of new electric car advert views on Auto Trader’s marketplace and are struggling to convert that interest into sales due to low consumer recognition. Brand awareness for BYD, GWM and Nio is below 5%, presenting a sizeable gap to Ford’s 80% recognition.

But that looks set to change after BYD overtook Tesla for the first time as the world’s biggest manufacturer of electric vehicles in the final three months of 2023, selling a record 526,000 vehicles globally. Searches for BYD cars trebled on the Auto Trader marketplace in the days after the news, accounting for more than 6% of all new electric car advert views.

Chinese brands also have room to cut prices as Auto Trader data shows the BYD Dolphin on sale in the UK with a starting price of £25,000 compared with a £13,000 price in China. The price gap is even bigger for the GWM ORA 03 (previously Funky Cat) on sale for £31,000 in the UK but just £12,000 at home.

This gap gives Chinese entrants the pricing power to take on established Western brands in the UK, where unlike other European markets there’s no dominant player, and competition for market share is more fierce according to Auto Trader experts. With ‘upfront cost’ the primary EV consideration barrier for 56% of buyers, pricing is set to become a key battleground in the EV transition. Here, BYD has a particular price advantage as it is also the world’s leading producer of rechargeable batteries, the most expensive component of an electric vehicle.

Volkswagen, Ford and Audi between them command less than a quarter of the UK electric vehicle market while research shows far less loyalty in the electric car market. Nearly half of would-be buyers are willing to switch brands when they switch to an electric vehicle – creating an opening for new entrants.

The competition among electric manufacturers to capture share is becoming more intensive with average discounts of 10.6% on the typical new electric vehicle compared to non-electric cars with 7.7% average discount, and four in every five new EVs comes with a reduced or zero finance offer as manufacturers try to tempt buyers and maintain their market share.

The added pressure of the Zero Emissions Vehicle (ZEV) mandate in 2024 – under which manufacturers must ensure 22% of their sales are electric, or face fines of £15,000 for every sale that misses the target – is also likely to build the pressure on prices as sellers look to tempt retail buyers.

Under the ZEV regime, 80% of cars sold in the UK must be electric by 2030 and data shows that the current average share of electric sales across brands is just circa 16%, and for some, it’s as low as 3%. Additionally, the used EV market is seeing record demand as prices match petrol and diesel equivalents. With plenty more supply coming in 2024, buyers will have a lot more choice of pre-loved EVs – and an alternative to new cars, adding further competition for carmakers’ new car ambitions.

Ian Plummer, Commercial Director at Auto Trader, commented:

“Drivers considering taking the first step on their electrified driving journey have never been in a better position to benefit from falling electric vehicle prices than in 2024.

“Even though the PM has pushed back the ban on sales of new petrol and diesel cars until 2035, the introduction of the ZEV mandate means that manufacturers are still under pressure to sell more electric cars and to do that, they’ll need to compete on price. The rise of China in electric cars will only add to that pricing pressure as they have the firepower to grab UK market share.

“To really ignite mass adoption of electric cars, the government should consider a fairer approach by equalizing VAT on public and private charging as well as reducing VAT on second hand electric cars.”

Auto Trader’s Road to 2035 Report is updated regularly as the electric market evolves, you can find the latest version of the release at: https://www.autotraderroadto2035.co.uk/

Image courtesy of Shutterstock.