The decision to push back the ban on the sale of new diesel and petrol cars to 2035 has caused significant uncertainty in the industry and could lead to a loss of over £100 million of investment in the UK.

That’s the view of respondents to a survey carried out by the Association for Renewable Energy and Clean Technology (REA) who strongly disagree with the Government’s decision to delay the ban from 2030 to 2035.

In a recent speech on the Government’s new approach to Net Zero Prime Minister Rishi Sunak ditched the 2030 ban on the sale of new petrol and diesel vehicles, rolling it back until 2035.

In a watering down of key green policies he also said there would be no new taxes on meat or flights and weakened targets on improving energy efficiency and the phasing out of fossil fuel boilers.

94% of 65 respondents to the REA survey do not support the announcements made in the Prime Minister’s speech.

97% specifically do not agree with the decision to move back the phase out date of ICE vehicles to 2035.

To this point, respondents said the following:

“The row-back was laid out under false pretences. Not only were there made-up policy redactions in regard to taxing meat, etc, but the basis for the rollback of the 2030 deadline for the ZEV mandate to 2035 is unfounded and was prefaced with a number of talking points that border on disinformation.’’

Another respondent said: “This flies not only in the face of common sense but will increase the cost of living.”

Another said: “It de-stabilises the whole Net Zero agenda, makes the UK look foolish and actually damages our chances of attracting and retaining any motor industry if we cannot offer policy security.”

One question asked of respondents was: Approximately what is the value of your committed investment now at risk following the decision to push back the target date for ending internal combustion engine sales?

In total, respondents highlighted over £100 million of investment in the UK has been put at risk because of the announcement.

One said: “We were due to close on commitments with 6 angel investors this week, 4 have now withdrawn. Potentially worth £150k to us as a humble start up.”

They were also asked how the push back to 2035 will impact their business?

Respondents highlighted the following:

“Creates uncertainty in investment decisions for clients, delaying project implementation, reducing the available work in decarbonisation in general and preventing businesses like ours from scaling, investing in skills and equipment, etc.”

“Without the investment, we are unable to scale and grow to keep up with infrastructure delivery and the risk is we will not build a rich enough dataset to sustain our business model and keep our clients happy.”

“It may delay inward investment to the sector which may impact the number of job opportunities in the UK. As a headhunter, we play a crucial role to connect great talent with great companies. OEM’s may opt for overseas locations instead of the UK which will reduce the demand for talent.”

Survey respondents were asked: Has your business based future investment and strategy based on the 2030 target which was first set by Government in 2020?

68% said yes.

A respondent said: “I work in the public sector in an organisation that is directly affected by these policy announcements. My job just got harder.”

Another respondent said: “My business could fail to secure investment as a direct result.”

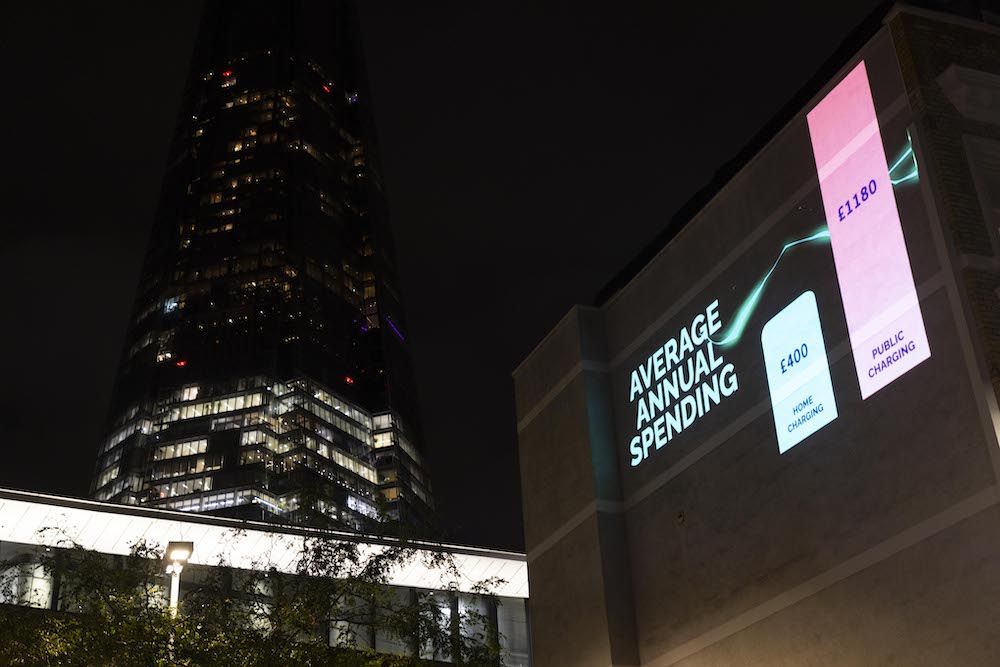

Others highlighted that investment in public and private charging facilities were being reviewed as they were previously planning investment based on the ambition of the Government’s 2030 policy.

Wider environmental impacts were also highlighted by respondents.

One said: “Softening investment by the auto sector will mean less diversity of models on the market, which means less choice, a slower fall in the cost of vehicles. It’ll also slow buyer activity. The result will be sales will slow = a slower reduction in traffic pollution emissions and carbon reduction = continued impact on health outcomes across the country, especially for low-income households and fuel poor who typically live in high pollution areas. A move to “let’s hope the public will do the right thing” policy cannot possibly lead to an increase in pace and can only lead to a decrease.”

The REA runs the electric vehicle (EV) trade group RECHARGE UK. A recent report ‘Charging forward to 2030: Critical success factors for the deployment and operation of UK-wide inclusive EV charging infrastructure’ sets out how to accelerate the rollout of EV charging by breaking down the policy and regulatory barriers to chargepoint deployment.

Responding to the findings of the survey, the REA’s Transport Policy Manager, Matthew Adams said:

“REA’s industry poll has confirmed that the decision to push back the phase out date of ICE vehicles to 2035 has caused significant uncertainty in the industry. Respondents highlight a lack of trust and confidence in the UK as somewhere to invest, no longer having confidence in the UK as a safe investment location, with over £100 million of investment reportedly at risk from the responses given.

‘’Some SMEs also report losing hundreds of thousands in investment as a result of a loss in market confidence. We are pleased to see the Government has however planned to combat future misinformation which has played a role in derailing market confidence in its Plan for Drivers and we are certain as we begin constructive dialogue with the Government and Opposition that they themselves will not inadvertently promote misinformation and will be able to actively challenge it instead.’’

‘’The REA has a proud history of working constructively with Government that spans nearly 20 years and we hope this insight from industry will prove helpful to all politicians going forward. In collaboration with FairCharge and Fully Charged SHOW we will work to improve Government communication around EVs. We look forward to sharing insights from our heating members who responded to the poll in the near future as well which as a sector has also been impacted by misinformation and disappointing policy announcements recently.’’

Image courtesy of Shutterstock.