European asset management and logistics solutions business Infinium Logistics has acquired three new assets for its FleetHubs property investment platform.

One of the world’s first dedicated EV fleet charging real estate funds, its assets include sites in Heathrow, Sheffield and Surrey, and have been acquired for a total consideration of £40m.

It takes capital deployed on behalf of the fund to more than £70m to-date, with further allocated follow on development spend of around £50m and a large pipeline of assets in advanced discussion.

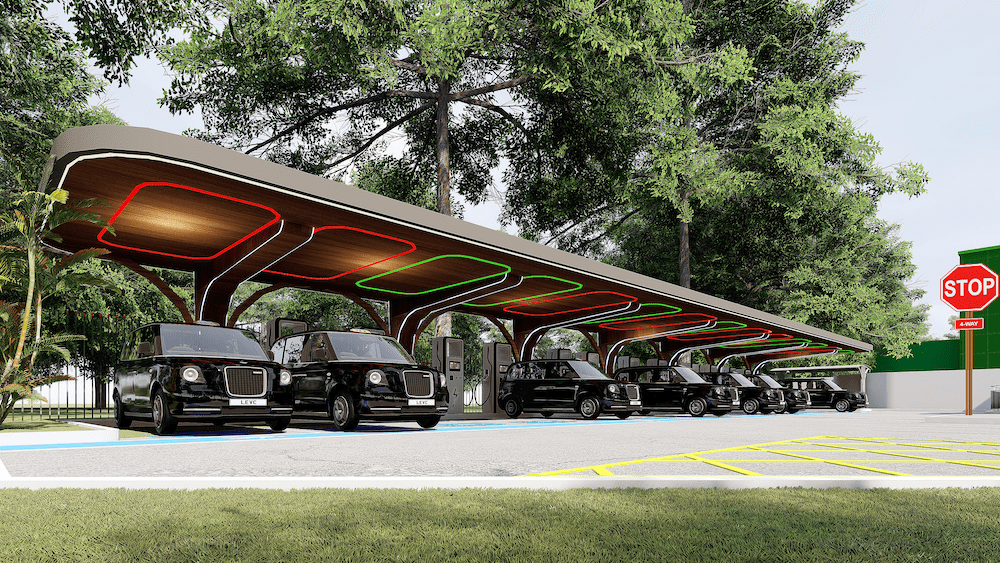

Infinium also invests in FleetHubs, a new sustainability-focused asset class, which combines commercial real estate and low carbon energy infrastructure, to create the next generation of parking and charging assets – which drives the lowest price and lowest carbon electricity solution for global fleets.

It acquired the Heathrow Flightpath car park for £22.5m from Aprirose, comprising more than 700 parking spaces across four acres.

Tom Markwell, Investment Manager at Infinium, said: “This acquisition is a pivotal step forward in Infinium’s mission to decarbonise, electrify and optimise commercial transport. As one of the world’s busiest airports, Heathrow symbolises a major hub for global traffic, making this an ideal setting to drive the transition to electric vehicles.”

In Sheffield, it completed the acquisition of the three-acre site, comprising an office building with associated car parking which was previously occupied by the vendor Insight, and in Surrey it has exchanged contracts on the acquisition of a site, with completion due in February 2024.

Speaking about the wider strategy, Phil Bayliss, CEO of Infinium Logistics, said: “Helping to deliver the clean energy transition through the electrification of commercial transport in real estate is an extraordinary opportunity. The role that the real estate sector can play as architects of a cleaner, greener mobility future is enormous and our generation’s defining, watershed moment in the drive towards a sustainable future. It will all start with great sites in high demand locations and these investments do just that.”

Tom Gough, Investment Director at Infinium, added: “These asset locations have been a primary focus for the past 12 months, so to land the three deals in such quick succession is a huge achievement for the business. They represent key locations for which critical EV infrastructure is needed and in turn will aid transport operators to transition to fully electric fleets and realise significant cost and operational efficiencies in doing so.”

Image courtesy of Infinium