China leads the global electric vehicle landscape following mass investment and is the “number one risk” to European OEMs – resulting in a possible £6bn-a-year loss – a new report has claimed.

The study by Allianz Research, found that having invested heavily in the past 15 years, China was well placed as it had “invested vast resources in building a competitive electric vehicle ecosystem”.

As a result, China sold more than double the number of battery-electric vehicles (BEVs) in 2022 compared to Europe and the US combined. Accounting for more than 80% of EV sales in their country, Chinese brands have seen their market shares climb from less than 40% in 2020 to close to 50% in 2022. At the same time, already in 2022, three of Europe’s best selling BEVs were Chinese imports.

The study said: “As BEVs eventually grow to account for all new car sales in Europe, Europe-made cars are likely to be substituted by those made in China – irrespective of whether they are manufactured by a Chinese, American or European company.”

But the report also said that the shift to BEVs was “a game changer for the European automotive industry” with alternative energy vehicle sales reached a record-breaking 4.4mn units in 2022 – representing 47% of all new vehicle registrations in Europe. BEVs led the way, with sales booming by +28%, representing 12% of all new vehicle registrations.

However, it said that European car makers could collectively lose more than €7bn Euros in annual net profit by 2030 if Chinese manufacturers increase their domestic market shares to 75% by 2030. Total sales in China by European carmakers would fall by -39%, with local production falling from an estimated 4.4mn units to 2.7mn in 2030.

It was also discovered by Allianz Research that if European imports of China-made cars reach 1.5m vehicles in 2030 – equivalent to 13.5% of the EU’s 2022 production – the impact on the European economy would stand at €24.2bn in 2030 for the automotive sector -the equivalent of 0.15% of the region’s 2022 GDP. Additionally, the automotive industry dependent economies of Germany, Slovakia and Czech Republic could face an even bigger hit: 0.3% to 0.4% of GDP.

The report called on policymakers to take action.

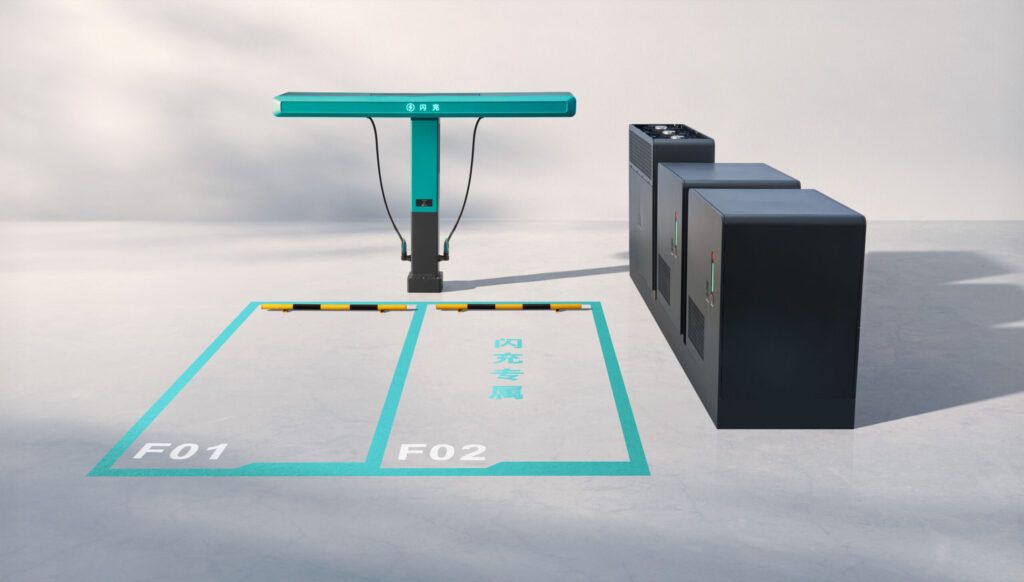

It said: “Given the strategic importance of the automotive sector for the European economy,policymakers could seek reciprocal trade terms with China and the US, as well as promote BEV adoption through improved charging infrastructure.

“Moreover, allowing Chinese investment in local car assembly could have more value added generated in the region, while increasing self-sufficiency in raw materials critical for battery manufacturing and investing in next-generation battery technologies will further help Europe’s automotive sector prepare for tomorrow’s challenges.”