A Heavy Goods Vehicle (HGV) infrastructure strategy is needed to address the absence of public HGV-dedicated charging and hydrogen filling points on Britain’s roads and to drive uptake of zero emission trucks to meet decarbonisation targets.

Analysis from the Society of Motor Manufacturers and Traders (SMMT) highlights how with just over a decade until the first end of sale deadline for the UK’s predominantly diesel HGV workhorses that Britain’s strategic road network has not a single HGV-dedicated electric charging or hydrogen filling point.

According to the SMMT, this lack of infrastructure makes it impossible for the vast majority of operators to contemplate investments to decarbonise their fleets, putting critical CO2 emission savings of up to 21.1 million tonnes a year at risk.

Mike Hawes, SMMT Chief Executive, said: “With just over a decade until the UK begins to phase out new diesel trucks, we cannot afford to delay a strategy that will deliver the world’s first decarbonised HGV sector. Manufacturers are investing billions in electric and hydrogen vehicles that will deliver massive CO2 savings, and it is vital that operators making long-term decisions today have full confidence in these technologies, that they will be commercially viable and allow them to keep costs down for consumers. A successful transition requires a long-term plan to drive the rollout of a dedicated UK-wide HGV charging and fuelling network, combined with world-leading incentives to encourage uptake and attract model allocation – a plan that will keep a greener Britain on the move and globally competitive.”

From 2035, all new HGVs weighing under 26 tonnes sold in the UK must be zero emission – the same date as for the car and van sectors, despite the EV truck market being two decades behind that of passenger cars. The remaining heavier vehicles must be completely decarbonised five years later, but the initial deadline leaves many operators with just one full eight-year cycle of fleet renewal to make the transition. While investment announcements for public car charging infrastructure are gradually flowing through, there is no equivalent plan for HGV-dedicated infrastructure.

HGV manufacturers are investing heavily in a broad range of electric and hydrogen models, however, these currently account for just one in 600 trucks on UK roads. A key concern for the sector is ‘charging anxiety’, which is felt acutely by operators with time-sensitive, long-haul business models. Delivering sufficient levels of public infrastructure would significantly increase operator confidence to make the necessary and substantial investments to decarbonise their fleets.

The expansion of infrastructure must also be matched to wider support for the sector. Given the unavoidably higher costs of zero emission vehicles and the necessary depot investments, operators whose businesses are run on tight margins and pence per mile calculations need to be incentivised to make the switch. The UK is behind many other countries in this regard as just eight of the 20 zero emission truck models on the market are eligible for the Plug-in Truck Grant.

The HGV sector keeps Britain on the move, last year carrying some 1.65 billion tonnes of goods, including food, medicines, clothes, household essentials, construction materials and waste, across the UK – a critical role that, with the right infrastructure in place, could be delivered on zero emissions, thanks to the latest cutting-edge vehicle technology being delivered by manufacturers.

SMMT is therefore calling for government to deliver a strategy within the next 12 months that focuses on the specific requirements of HGVs to enable operators to plan and invest, while minimising additional logistics costs that inevitably would be passed on to the consumer. The strategy must improve incentives for operators to encourage investment in zero emission trucks; it must set out a plan to support and coordinate the installation of public and depot-based charging and refuelling points, in the right locations across all regions of the country; and it should include reforms to support investment, planning and energy provision to facilitate critical depot-based infrastructure.

SMMT’s key recommendations:

- Suitable funding commitments to HGV decarbonisation

- Competitive purchase incentives for zero emission trucks

- A national plan for installing depot infrastructure

- Deliver critical public and en-route infrastructure

- A dedicated HGV infrastructure strategy by Spring 2024

Industry reaction:

Alex Harrison, partner at Akin, said: “SMMT is right that public charging infrastructure suitable for medium and heavy goods vehicles is lagging behind that for passenger cars and light commercial vehicles. There remains considerable uncertainty around the location, type and speed of infrastructure needed for these vehicles with National Grid estimating that 70-90% of HGV energy provision will be done overnight at depot or destination and only the remaining 10-30% needing to be provided en route at motorway and trunk road service stations. The optimal locations for road freight charging will depend both on vehicle routes, but also on coinciding the availability of charging with mandatory driver rest breaks. A UK government infrastructure charging strategy for HGVs and how the UK’s Rapid Charging Fund could be used to support deployment for the sector would be very helpful to drive investment and incentivise the transition.”

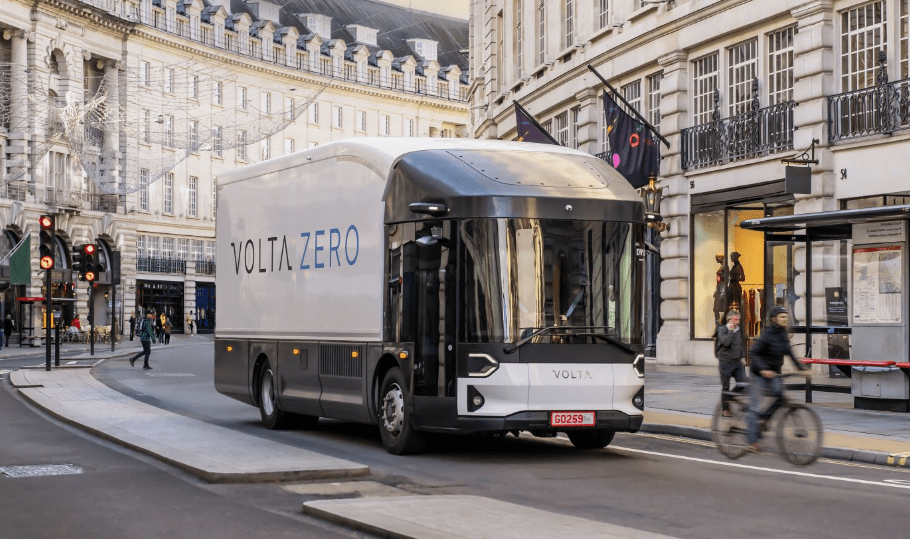

Image courtesy of Volta.