Guillermo Martinez, Europe Industrial and Logistics lead, Director, Turner & Townsend, looks at how a battery start-up can survive in a highly competitive industry.

A lot has been written over the past few months about the challenges for start-up battery manufacturers in the UK and the rest of Europe to scale up, commercialise and get into giga-scale production. Look across the continent and the map of proposed gigafactories is crowded, but the reality, without being too defeatist, is that not all proposed sites will come forward.

There’s no silver bullet for battery cell manufacturers to raise the capital to deliver a gigafactory. Except for a very small number of players, almost every project depends on external project finance or high-volume subsidies. Successful delivery then depends on a combination of factors, such as the ability of companies to maintain their strategic focus, develop their production lines, obtain offtake agreements and making the right decisions in the construction process.

Government support and market incentivisation also have a role to play in providing the assurance needed to secure large-scale institutional investors, with an opportunity arising for the property community to develop some different models specific to the battery industry.

So how can start-ups scale up and what support do they need now? Here are some observations and recommendations from Turner & Townsend’s own work delivering gigafactories across Europe.

Start-ups need a razor-sharp strategic focus on their cell technology

Aside from a lack of financial scale, the to-do list for battery start-ups is long and the distractions can be significant. These businesses are usually trying to develop and commercialise technology, and understand how to hit giga-scale production rates, often from an existing or newly built small R&D facility.

Meanwhile their potential original equipment manufacturer (OEM) customers, usually with a long-standing industrial track record, require extensive testing of their cells before making commitments. In parallel, battery manufacturers need to demonstrate to the investor community that they have future paying customers and a sustainable and investable business. Beyond the product, they also need to secure a large site with planning approval which can meet the size, logistics and power requirements of a gigafactory and have access to renewable energy.

Cutting through these challenges requires a clear strategic direction from the management team and focus on the cell technology they are commercialising. They are often agile businesses with ideas and impressive R&D, but in a global market, often competing against established players, they need to be very clear about their product offer and chosen end markets. Get this right, and there is a much better chance of getting the other pieces of the programme to fall into place. Spread too thin, and the cash resources can be consumed before successfully being able to commercialise the product.

Externalise the team to deliver a gigafactory and ‘right-size’ the facility

Linked to the need to focus on their core business and commercialising their product, my next recommendation is that start-ups draw upon external capabilities and expertise to support their gigafactory ambitions. This is because the delivery of a building from site acquisition through to build is complex and requires expert skills and resources to be drawn from competing and successful industries.

Land transactions are a time-consuming process. They involve extensive technical and legal due diligence which is highly specific to the geopolitical context. An appointed transaction manager for real estate can effectively manage approvals and documentation, with an understanding of the local market context and relationships developed over time.

There is a need for teams to understand all the risks and opportunities related to building an asset in a given location and to plan for a facility which is right-sized for their business and ability to secure investment. Getting the site choice wrong will severely affect project timeline, budget and therefore business plan, which can prove to be fatal for a startup.

From understanding the consenting needs, to benchmarking construction costs and mapping typical delivery models in the country, a comprehensive location study is paramount to getting the location right. Nominating a trusted, independent advisor to perform this study is an investment that several players in the industry have already made, which has added assurance to the decision making on such a strategic aspect as the location.

Start-ups need Government support

The global battery ‘arms race’ is not a level playing field and policy-making like the Biden Administration’s Inflation Reduction Act (IRA) has effectively redrawn the global green investment map. Since the President entered the White House in 2021, $92bn of investment has been funnelled into the US battery supply chain according to the US Department of Energy. There are 78 manufacturing and processing facilities in the pipeline and there is clear US support to create a national battery ecosystem, including recycling and upcycling, materials sourcing and transformation as well as component manufacturing. The latest example of size is Redwood Material’s $2bn Federal loan to build a state of the art battery recycling facility.

This is attractive to investors and for markets like the UK and Europe to compete, they now need additional Government support to create the conditions for success in the battery market. This will require an end-to-end battery industrial strategy which will provide greater incentives to investors but also better levels of financial support for start-ups with viable business cases. Critically, this strategy must be alive to the need to have a UK cell manufacturing sector – and supply chain – that is diversified. On one hand it should be geared up to support the automotive market, but it should also have the potential to produce cells for the increasingly critical energy storage market too.

Start-ups need support from property developers and investors

The capital cost of gigafactory construction and the fit-out of these assets is expensive and complex, representing a barrier to entry for many start-ups. Against this backdrop, the industrial property market in many European markets is based on long term leasing models with occupiers, particularly in the logistics sector.

So could developers design and build gigafactories and provide long term lease agreements for battery start-ups? If this isn’t palatable as there is not yet a standard facility type in the sector, could the deal be guaranteed and risk shared by a public sector partner? Could this be facilitated for simpler, smaller scale facilities as the pilot plants similarly to what is seen in some Nordic countries? New leasing models are needed because the reality is that many start-up companies will struggle to raise the funds for their own gigafactory. Equally, some will not have the required covenants in place to secure lease facilities. This calls for some different options from property developers with the support of ESG-orientated investment funds and Government partners to back the risks of potential private landlords leasing a facility to a newly created startup.

The road to commercialisation for any start-up in any sector comes with many hurdles. In a competitive global battery market which is being shaped by command economies and state intervention, it is particularly challenging. Positively, there are start-up companies across the UK and Europe with great ideas, innovation and agility. To ensure this technical and entrepreneurial advantage isn’t lost, they need the support of Governments via well considered industrial strategies and for the property market and contrsuction industries to be open to establishing new partnership models, as innovative and entrepreneurial as those companies are.

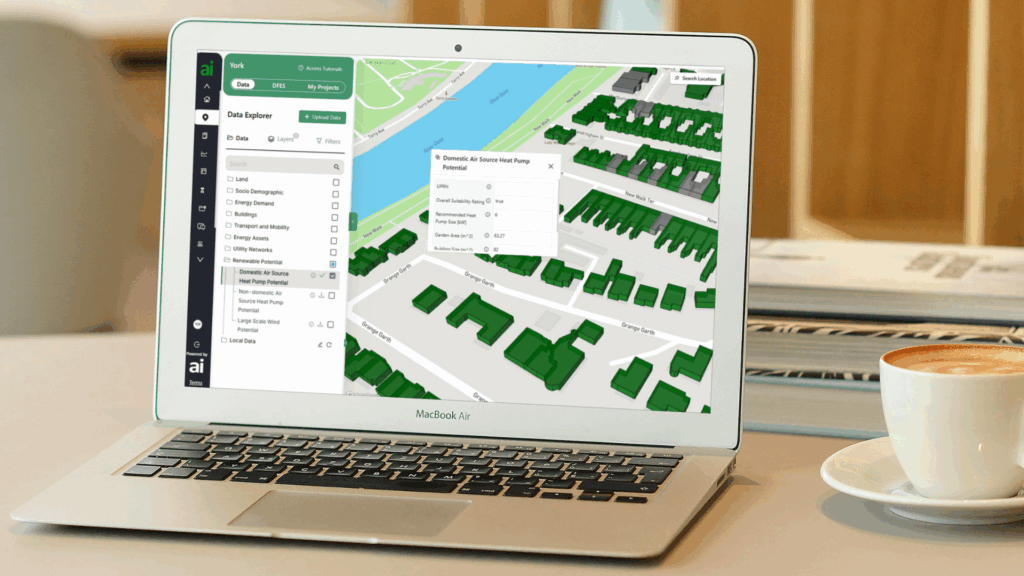

Image courtesy of Turner & Townsend.