Hiten Sonpal has been appointed as Head of Green Finance for MHA – the top 13 accountancy network.

Formerly Director of Climate Propositions for the NatWest Group, Hiten has served as the lead for green finance offerings in his previous roles over the past 12 years. At Natwest he spearheaded the growth of the group’s renewable lending business.

Hiten specialises in innovative green finance structures supporting UK businesses in reducing their overheads and emissions through energy efficient technology. His expertise in green asset finance includes renewables, clean energy and zero emission mobility. Prior to joining MHA and to his role at Natwest he was Head of Specialist Sectors at Lombard.

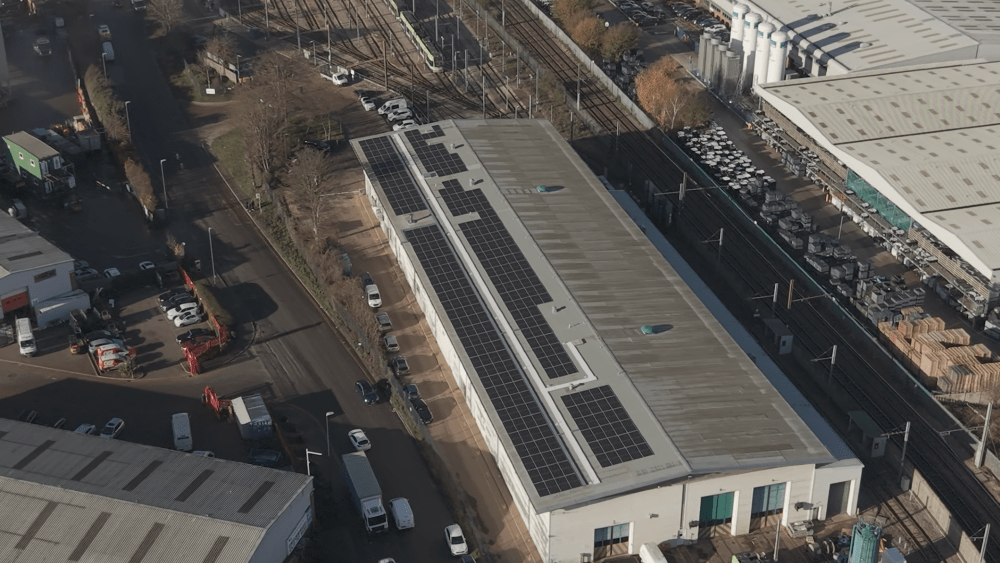

Hiten’s appointment forms a key part of MHA’s rapidly growing sustainability and green finance capabilities. The network aims to support clients’ green commitments and ambitions in the face of high energy prices and a challenging economic environment. Hiten will be responsible for growing MHA’s green finance offering by providing lending and advisory services to support businesses achieve their climate change goals through renewable energy initiatives.

Hiten Sonpal, Head of Green Finance at MHA, said: “I decided to join MHA as it was clear the firm shared my passion for sustainability and believes in the importance of green finance in supporting the UK’s net zero goals. MHA has shown commitment to innovation and being part of an organisation that encourages colleagues to think outside of the box, putting clients’ needs at the forefront of everything it does, was one of the key drivers in my decision to take this new role.

“Green asset finance is now more important than ever. For our clients it not only helps them achieve their own green credentials but also protects their future as a business with energy security.”

Rakesh Shaunak, Partner and Chairman of MHA, added: “Businesses of all sizes are coming under increasing pressure due to rising energy costs. More than ever wise investments in green technology can help businesses develop sustainable cash flows. For this reason we decided to further enhance our sustainability capability with a more comprehensive green finance and asset offering under Hiten’s capable and experienced stewardship.

“Hiten has high level expertise in supporting businesses onto a more sustainable operational footing. His wealth of technical expertise on green finance lending and his understanding of where the renewable energy market is heading will be incredibly valuable to both the team and our clients. We look forward to delivering real value to businesses as they aim to operate more sustainably in 2023 and beyond.”