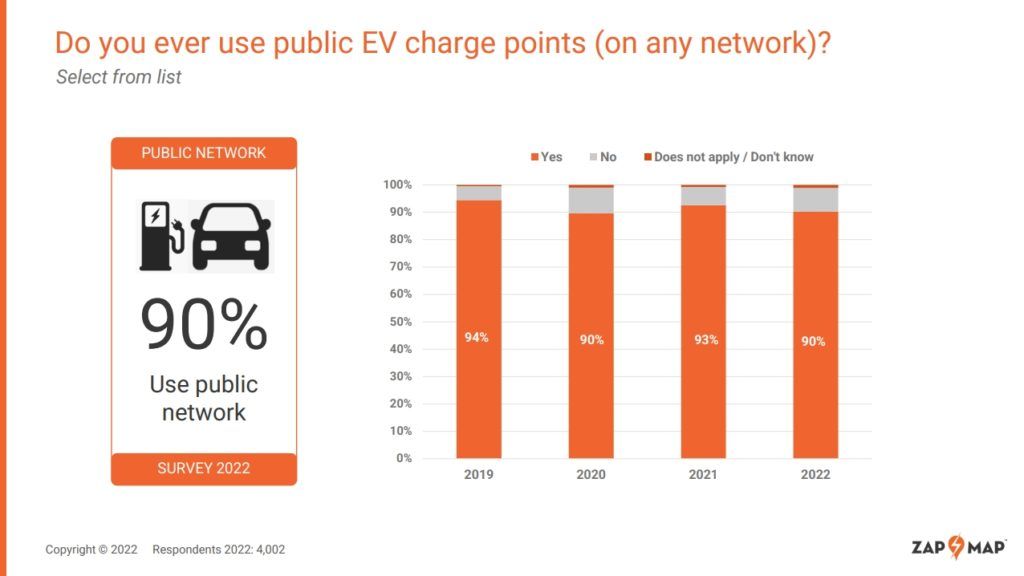

A survey of electric vehicle drivers carried out by Zap-Map has revealed that the vast majority of EV drivers (90%) continue to use the UK’s public charging networks on a regular basis – whilst also revealing a significant increase in usage of EV charging hubs.

The annual EV charging survey, which was conducted in September 2022, is the most established poll of EV drivers in the UK – and this year saw record responses from more than 4,300 Zap-Map users.

The survey covers a broad spectrum of topics. From the main reasons people are buying electric cars, through to sentiment on charging prices and EV owners’ driving and charging habits, Zap-Map’s survey uncovers how EV drivers are interacting with the different types of location available to charge their vehicle.

Perhaps most importantly, the poll drills down into key aspects of electric car charging behaviour, such as what types of charger drivers are using, where they tend to charge, and how long their charging sessions last.

For example, the survey examined the spread of charging across different types of charging locations – home, work or different public charging location types – and then looked at how driver behaviour changes when unable to access a home charger. The findings therefore provide analysis on how drivers without a home charger use the public network, and how this differs to drivers able to charge at home.

Indeed, although 84% of respondents have a home charger, the vast majority of EV drivers (90%) continue to use the UK’s public charging networks on a regular basis. In fact, the findings of the survey show that most use the public network on a more or less monthly basis, with some using it much more frequently and others less so.

The survey also found a significant increase in usage of EV charging hubs, partly due to the number of longer-range EVs now available. Indeed, hubs such as these are now the third most popular location type after supermarket car parks and motorway service stations, which continue to be the two most popular charging locations.

As such, while Pod Point remains the network used by the highest number of respondents on a regular basis, this year sees InstaVolt and GRIDSERVE – two networks installing these charging hubs – moving into second and third place in terms of popularity. Indeed, 41% of respondents said they regularly use InstaVolt chargers, while 40% said the same for GRIDSERVE Electric Highway – up from 29% last year.

Other key findings from the survey include a new top 21 ranking of charging networks based on driver satisfaction, with Fastned and MFG EV Power – two ultra-rapid charging networks providing reliable charging hubs – coming in joint first place, followed by InstaVolt in third.

Melanie Shufflebotham, Co-founder & COO at Zap-Map, said:v“With the number of pure-electric cars on UK roads now over 600,000, the country needs a public charging network able to cope with a diverse range of needs.

“As EV adoption accelerates and enters a more mainstream demographic, how EV drivers without a home charger go about charging their car will be a key question over the coming year and beyond.

“Although the survey currently shows that more than 80% currently have a home charger, the need for on-street and other local charging provision is only going to become more pressing.”

Of course, it’s not only charge point operators that are affected by the transition to electric vehicles. Charge point manufacturers, local authorities and other government bodies, vehicle manufacturers, fleet drivers and managers, and consumers are all affected by the changing nature of the UK’s charging infrastructure and people’s interaction with it.

Jade Edwards, Head of Insights at Zap-Map, said: “Given the broad range of sectors involved in the transition to electric vehicles and the expansive nature of the poll, this year’s survey is available in a variety of tailored reports.

“With the expansion of the UK’s charging network affecting many organisations across the country in different ways, this survey is key to understanding how the EV landscape is changing in front of our eyes, and to identifying trends across en-route, destination and on-street charging.”

Image courtesy of Zap-Map.