Rob King, Operations Director at E-Car Lease, asks if leasing brokers, car retailers and finance companies are prepared for automotive electrification.

The seismic growth of electric cars, and vans, has taken many businesses by surprise. Even our own business, which moved away from traditional combustion engines and towards electric vehicle leasing six years ago, has been astounded by the sharp increase in demand from a wide array of customers looking to procure a zero-emission option. And one of the biggest surprises is that it isn’t just company car, or salary sacrifice, customers looking at EVs; personal contract hire / retail customers are also making the transition in volumes beyond our own expectations. For our business, the catalyst was the impact of COVID and lockdowns which not only reduced annual mileages through home working but almost seemed to create a more conscientious consumer overnight. A noticeable interest in greener and more environmentally-sustainable transport options was supplemented by other factors such as Whole of Life cost analysis and the enhanced driving experiences an EV can offer. Indeed, the mass-adoption of the Tesla Model 3 in 2020 was a true testament to a change in buyer habits.

But are businesses selling, leasing or renting EVs ready for the increasing demand? While businesses like ours profess to be “electric vehicle experts”, the truth is that we started without any guidance or rulebook which set out what our businesses should know and what each customer should understand as part of this procurement process. Fast-forward to 2022 and we are still very much at the same stage with many similar businesses to ours using experience, intuition and technological integrations to ensure that our customers are provided with a robust experience. And this isn’t just about adhering to legal and regulatory frameworks; this is about enhancing the electric vehicle industry as a whole because we are very much at the coalface of this movement. Of course we need electric infrastructure, public and home charge point solutions, utility company charging plans, electric car insurance, fleet analytics and so forth but all of this is superfluous if the industry isn’t adequately supplying the vehicles in the first instance (not taking into account microchip and parts shortages).

Understanding what customers do need to know is not without challenges. Much of what you see in the mainstream media focuses on conversations about range without properly understanding how range actually influences an EV driver. Not unlike mpg on combustion engine, you will note that many manufacturer and vehicle sales websites only show one “absolute range” statistic on a vehicle (based on a 100% charge.) The early issues we encountered were therefore centred around vehicles not performing in accordance with WLTP suggestions or drivers spending more time charging than they had factored. Further queries about charging cables, charging times and running costs exacerbated concerns about our customer journey and whether it was fit for purpose in the long-term. But in recognising all of these issues, it made it possible to create a non-exhaustive list which almost any customer should have to understand before committing to their vehicle:

These are just some of our suggestions for businesses engaged in (or looking to engage in) the selling, leasing or renting of EVs. Not all of the below will be suitable in every instance. Nor are these formally approved by any regulator or ombudsman.

- Range – identify to a customer that weather conditions, driver-style and behaviours influence the range of the EV. In particular, show the divergences in range in a simple and digestible format. The focus is on educating the customer to understand that there will be variables and that there should no alarm (or allegations of mis-selling) where discrepancies arise;

- Battery capability – set out to the customer the battery capacity, as you would do in the case of engine size on a combustion vehicle. The size of the battery can be used to understand the costs associated in “fuelling” the EV once you know the electricity cost (show as pence per kWh). Based on the range metrics above, this can be used to then show a “cost per mile” calculation. Some fleets, or conscientious consumers, can utilise this as part of combustion v electric analysis;

- Charging capabilities – set out the charging capabilities of the EV in both AC and DC format. Charging times are as, if not more, important than range and not all EVs are born equal! The customer needs to correlate the charging rate of their EV against the intended charge point they will utilise. For example, the onboard charger may allow for 7, 11, or 22 kW AC charging which could then influence the charging infrastructure employed by the customer or manage their expectations on charging times. As some manufacturers will offer enhanced charging rates as an upgrade, this is useful for explaining to the customer why that would be a relevant upgrade. The same will apply for DC, or rapid charging, in that EVs will have different capabilities, as does the public charging network. Charge point location services, like Zap Map, will be useful here in that they should not only show the closest charge point geographically but they should also show the most efficient / quickest option;

- Charging times – use simple visual tools which illustrate the speed an EV will take to charge using a standard home socket (3-pin plug), a dedicated charge point and a rapid charging solution. Some customers may not appreciate the benefit of a dedicated home / workplace solution for charging an EV particularly as there is an upfront cost to this. The time it takes to charge many bigger battery EVs on a 3-pin plug is often underestimated by many customers;

- Charge point locations – encourage customers to use services like Zap Map for understanding how and where to charge their EV. Anxiety over charge point infrastructure can be effectively overcome with educational apps. And in many cases, until you drive an EV, you will not have noticed the charge point solutions available to you;

- Company car tax tools – utilise simple car tax calculations for setting out the cost benefits to company car and salary sacrifice customers. From April 2022, the 2% BiK should be identified to drivers, fleet managers and directors as part of Whole of Life cost calculations;

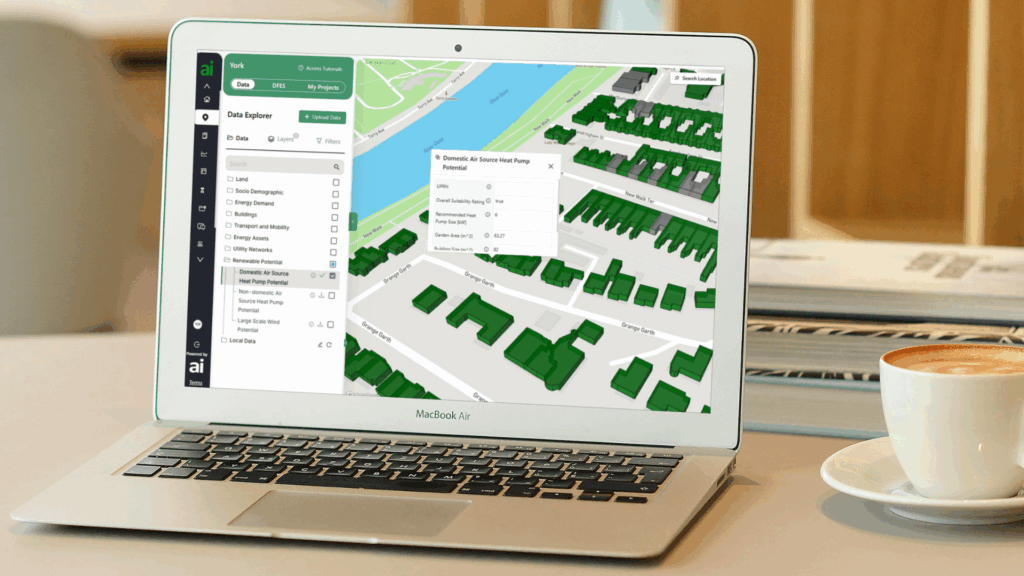

- Other tools – depending on your business, consider charge point, electric car insurance and utility company comparison tools. Technological integrations not only enhance customer experience (when correctly applied) but they improve your company’s EV proposition; and

- Miscellaneous – include information about charging cables at a minimum. Some manufacturers provide type 2 cables whereas others supply a cable for utilising a 3-pin plug. Or, in some cases, you get both. For multi-brand businesses, it would be practical to move away from the assumption that all vehicles are consistent. Consider other elements like plug types, charge point locations or fuel suitability tools as part of the sales process.

Through collaboration and information sharing, many of the envisioned obstacles to electric transport can be overcome. Institutions like EVA England (https://www.evaengland.org.uk/) and the BVRLA (https://www.bvrla.co.uk/ev-hub.html) are crucial for gathering feedback and for disseminating this to the relevant stakeholders; the Government, finance companies, leasing brokers and franchised dealerships all have an enormous part to play. It is our belief that greater consistency though agreed sales processes will ensure the UK’s move into electric vehicles is a seamless one. For example, using an EPC rating style certificate on an electric car, as you would use for buying a house, could help cement some of the points noted above. Moving into the electric vehicle market should not raise any immediate concerns for any leasing broker, car retailer or finance company so long as they apply due consideration of some, or all, of the points above. For many businesses, like ours, this could be the chance to start again and help set new standards for the UK’s automotive industry.