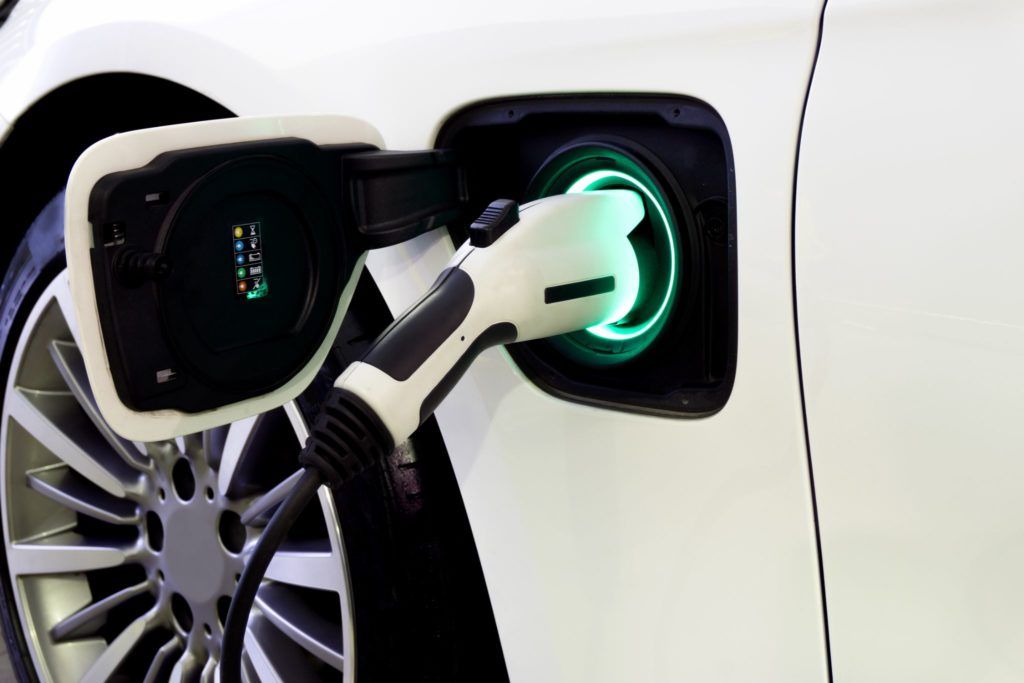

The Government has recently rejected a proposal to bring VAT on electricity charged to drivers using public electric vehicle charge points into line with that charged to those charging vehicles at home.

Stephen Metcalfe, Conservative MP for South Basildon and East Thurrock, had asked the Chancellor if he would make an assessment of the compatibility of differing VAT rates for public and domestic charging of electric vehicles – with the principle of VAT neutrality.

Speaking for the Treasury, Helen Whately, Conservative MP for Faversham & Mid Kent, answered that: “Applying the reduced rate of VAT to electricity supplied at EV charging points in public places comes at a cost.

“VAT makes a significant contribution towards the public finances, raising around £130 billion in 2019/20, and helps fund the Government’s priorities including the NHS, schools, and defence. Any loss in tax revenue would have to be balanced by a reduction in public spending, increased borrowing or increased taxation elsewhere.

“The Government has no current plans to review the current rate of VAT applied to EV charging.”

Responding to this statement, RAC’s head of roads policy, Nicholas Lyes, said: “It’s disappointing the Government appears to be closing the door on fairer taxation for electric vehicles. The real issue is that those EV owners without driveways will be hugely dependent on public chargepoints, so it cannot be fair they are effectively being hit with a much higher rate of taxation than those that can charge at home.

“If the Government wants to make electric vehicle ownership truly universal, it needs to rectify this anomaly quickly.”

Quentin Willson, founder of the RAC-backed FairCharge campaign, and transportandenergy.com editorial board member, said: “With the huge windfall in Treasury receipts because of higher oil and fuel prices there’s plenty of fiscal room to bring VAT on public charging down from 20% to 5%. For those without driveways or parking spaces the 20% VAT levy will mean millions of voters will be excluded from driving an EV.

“This is a massive Treasury policy blunder with serious societal implications. FairCharge has worked out that at the current rate of EV adoption, lowering the VAT on public charging would cost just £14 million. That’s a tiny raindrop echoing in an ocean.”

Image: Shutterstock