EQT Infrastructure has agreed to acquire InstaVolt, the UK’s fastest-growing independent rapid electric vehicle charging operator, from Zouk Capital.

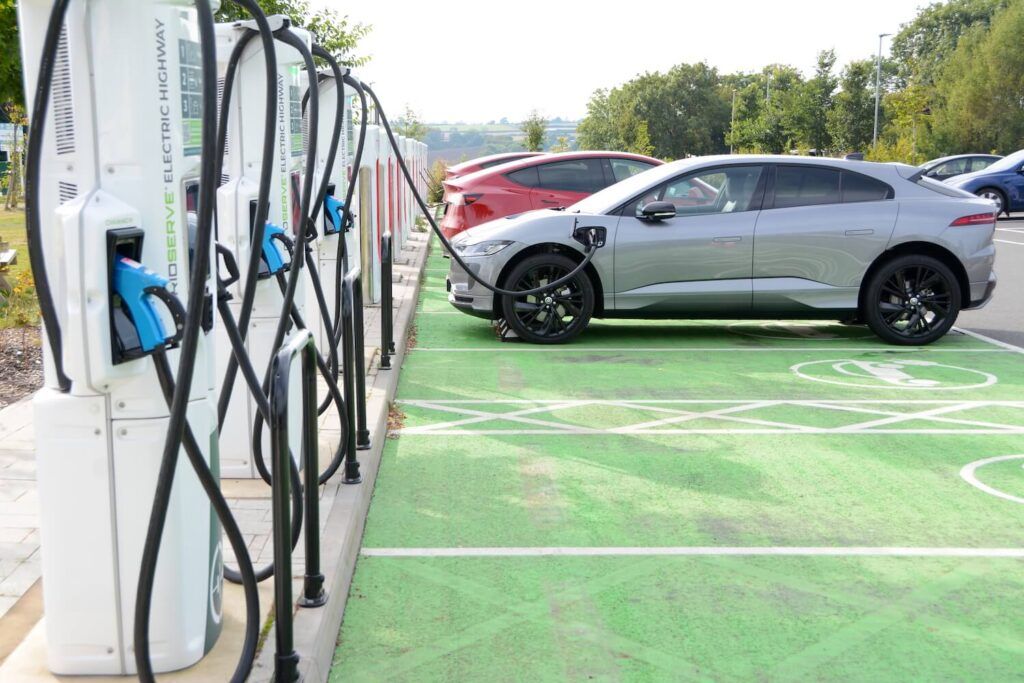

Headquartered in Basingstoke, UK, InstaVolt is an operator and owner of electric vehicle (EV) charge points with a nationwide network of approximately 700 charge points across the UK.

EQT Infrastructure will invest significantly in InstaVolt’s accelerated roll-out of charge points to reach a nationwide network of 10,000 rapid electric vehicle chargers by 2032. Instavolt’s strong market position, combined with EQT’s deep knowledge within energy transition and sustainability, will set-up the charge point operator for “further success, both in the UK but also abroad”.

Anna Sundell, Partner and Head of EQT Infrastructure’s UK Advisory Team, said, “The future is electric and InstaVolt is essential to the roll-out of EV charging infrastructure across the UK, a prerequisite for enabling mass adoption of EVs. We are excited about supporting InstaVolt in the next phase of growth and for EQT to play its part in decarbonising the transportation sector and driving the transition towards net zero in the UK and beyond.”

Adrian Keen (pictured above), InstaVolt’s Chief Executive Officer, added: “InstaVolt has set a standard in the UK for driver experience and infrastructure, and now with support from EQT, we are in a unique position to accelerate that target and replicate our model in other geographies, transitioning the business into the next phase of growth. We want to thank our partners and customers who have supported us on our journey so far and want our customers to be reassured that what has made InstaVolt so successful, including our focus on reliability and ease of use, remains unchanged.”

The investment sees founding investor Zouk Capital exit after establishing the company with the InstaVolt management team in 2016. Zouk is the manager of the Charging Infrastructure Fund (“CIIF”) and has a central objective of scaling open-access, public EV charging networks for the UK’s EV drivers.

Massimo Resta, Partner at Zouk Capital, said: “The InstaVolt team and Zouk identified the opportunity in 2016 and built one of the leading rapid EV charging infrastructure companies in the UK. We believe the management team are in great hands with EQT and wish InstaVolt the very best for the next stage of their journey.”

InstaVolt’s charge points are most often situated at retail, food, beverage and forecourt sites, offering a convenient service for the end-user who can combine their charge with other day-to-day activities. Current partners include McDonald’s, Costa Coffee and Booths, among others. By providing a reliable, easy-to-use and easily accessible service to its customers, InstaVolt has been rated the most popular open network by EV drivers consecutively for the last four years.

RBC Capital Markets acted as exclusive financial advisor and Simpson Thacher & Bartlett acted as legal advisor to EQT Infrastructure.

UBS acted as exclusive financial advisor to Zouk and InstaVolt, with Travers Smith acting for the company and management on the sale and Fladgate acting for the institutional seller.

With this transaction, EQT Infrastructure V is expected to be 65-70 percent invested (including closed and/or signed investments, announced public offers, if applicable, and less any expected syndication) and subject to customary regulatory approvals.

Last year Transport + Energy caught up with InstaVolt’s chief executive officer, Adrian Keen to talk about the early days, the opening of the UK’s largest public rapid charger motorway hub, its relationship with leading consumer brands, and much more.

Images courtesy of InstaVolt.