New research from ING’s macroeconomics team calculates the mountain to climb to achieve Asia’s race to net-zero.

New calculations from ING Bank’s macroeconomics team reveals the mountain to climb for Asia in its race to net-zero. They show that the cost of new electricity generating capacity to supply a carbon neutral transport sector alone in China, Japan, and South Korea will amount to US$12.4 trillion (approx £9 trillion).

With growing demand for Asian economies to increase efforts against global climate change, ING’s research also shows that this sum becomes more manageable if the transition process starts today, and is spread over the next 30 years (40 in the case of China).

In this scenario, the annual costs drop to more manageable figures – 0.6% of current GDP per year for Japan and Korea, and 1.8% for China. The report comes as China, Japan, and South Korea set their sights on reaching net-zero despite currently accounting for about two-thirds of total Asian emissions.

The research, released in a new report titled ‘Asia’s race to net-zero carbon: $12.4 trillion and counting’ – The cost of greening Asia’s transport and generation capacity’, explores the cost of supplying a new generation of net-zero carbon transport with the clean and green electricity needed to ensure these targets are to be met.

Sector by sector, road transport offers one of the easiest and cheapest areas for the transition to net-zero as battery electric vehicle (BEV) technology is already well advanced. Yet, for marine transport, the transition is proving controversial with the industry disputing what a net-zero carbon alternative looks like.

There is little room for improvement in rail transport as the industry is already electrified in the region.

In China; the largest contributor to global emissions, the transport transition will amount to 1.8% of GDP per year through to 2060 as the country remains heavily reliant on fossil fuels.

Growing rail transport demand in China will require an additional 344GW of capacity at a cost of US$2.9tr, equivalent to 0.49% of GDP in 2020 terms each year over 40 years. Elsewhere, the maritime and aviation sector’s reliance on fossil fuels till 2050 will likely require a carbon capture offset or other mitigation efforts in order to achieve net-zero.

Ultimately, most of these costs are likely to be met by the private sector and could be financed with green bonds, sustainability-linked instruments, or by green financial tools that have yet to be invented.

ING Regional Head of Research Asia-Pacific, Rob Carnell, said: “Making pledges and actually doing what is necessary to achieve net-zero carbon are not the same things. By looking at transport – just one part of China, Japan and South Korea’s transition – we can begin to capture a sense of the daunting scale of what lies ahead.

“We cannot underplay the gulf between the net-zero carbon goals and the paths set out to achieve those goals. Most governments have barely scratched the surface on tackling the transition and the path ahead will no doubt lead to considerable disruption for existing industries. However, there is also the possibility that this process can help reinvigorate stagnating economies and – if time is not wasted now – this is still a manageable prospect.”

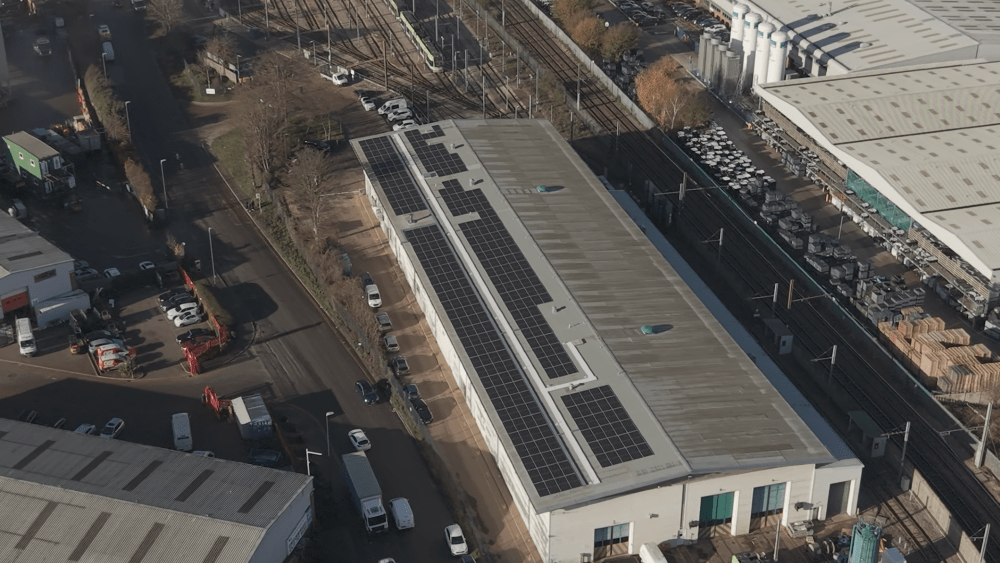

Image: Shutterstock