The UK road transport sector stands on the cusp of great change, with clear indicators of movement away from the internal combustion engine (ICE) and towards electric vehicles (EV). Energy Institute analyst Daniel de Wijze takes a look at what has been going on under the bonnet of the fuel retail industry during a year unlike any other.

2020 will sadly be remembered as the year of the Covid-19 pandemic, which dramatically altered life for people around the world. The impacts of the pandemic were clearly seen in the UK’s road transport sector, as revealed by updated analysis from the Energy Institute, based on data from Experian Catalist and ZapMap. A year of lockdowns and restrictions on movement impacted on the price of fuel – reaching a low in May some 15-16% down on the start of the year – and the volume of fuel sold, which was down 23% on the previous year. National lockdowns and regional restrictions on travel led to a big drop in the number of new vehicle registrations, and across the year the total number of vehicles registered only rose by about 0.4%.

However, beyond these short-term impacts, our analysis sees long-term trends unchanged including the continuing closure and consolidation of conventional retail fuel outlets – now down to 8,384, the lowest number since records began – and strong growth in the number of EVs and EV charging infrastructure.

Growth of EVs on the UK’s roads

In May 2021, the UK reached the milestone of over half a million ultra-low emission vehicles (ULEV) registered. In order for the UK to achieve its goal of net zero emissions by 2050, unprecedented numbers of ULEVs (reported to emit less than 75g CO2 per km from the tailpipe) will need to find their way onto roads. In the main, ULEVs are electric – either a battery electric or a plug-in hybrid. While there has been considerable excitement around other alternative fuels such as hydrogen, these options are still in the embryonic stage; there are only around 200 hydrogen fuel cell vehicles in the UK, and fewer than 20 hydrogen fuelling stations.

According to the Department for Transport, the most popular plug-in EV models registered in 2020 were the Tesla Model 3, BMW 3 series and Kia Niro. The popularity of the Tesla, a luxury vehicle which costs over £40,000 at a minimum, illustrates how buying an EV is still frequently the pursuit of wealthier drivers. EVs are slowly becoming more cost-competitive with petrol and diesel cars, but at present they remain out of reach for many.

Signals from the Government have been mixed; the ban on ICE-only cars and vans from 2030 (hybrid vehicles will still be allowed until 2035) provides a strong signal to the automotive industry on the direction of travel. However, recent moves by the Chancellor to reduce grants available for purchasing EVs (down from £3,000 to £2,500), and to freeze fuel duty for a tenth consecutive year, send a contradictory message. It may be that government intervention is not required to spur uptake of EVs, thanks to falling battery costs and improved charging infrastructure. However, with ULEVs accounting for little more than 1% of all vehicles on the road, these recent interventions send a muddled signal to drivers and could slow the pace of progress.

EV charging infrastructure

As part of Prime Minster Boris Johnson’s 10 point plan for a green industrial revolution, the Government has pledged to invest £1.3bn in charging infrastructure, with targets of 2,500 new high-powered charge points by 2030, rising to 6,000 by 2035.

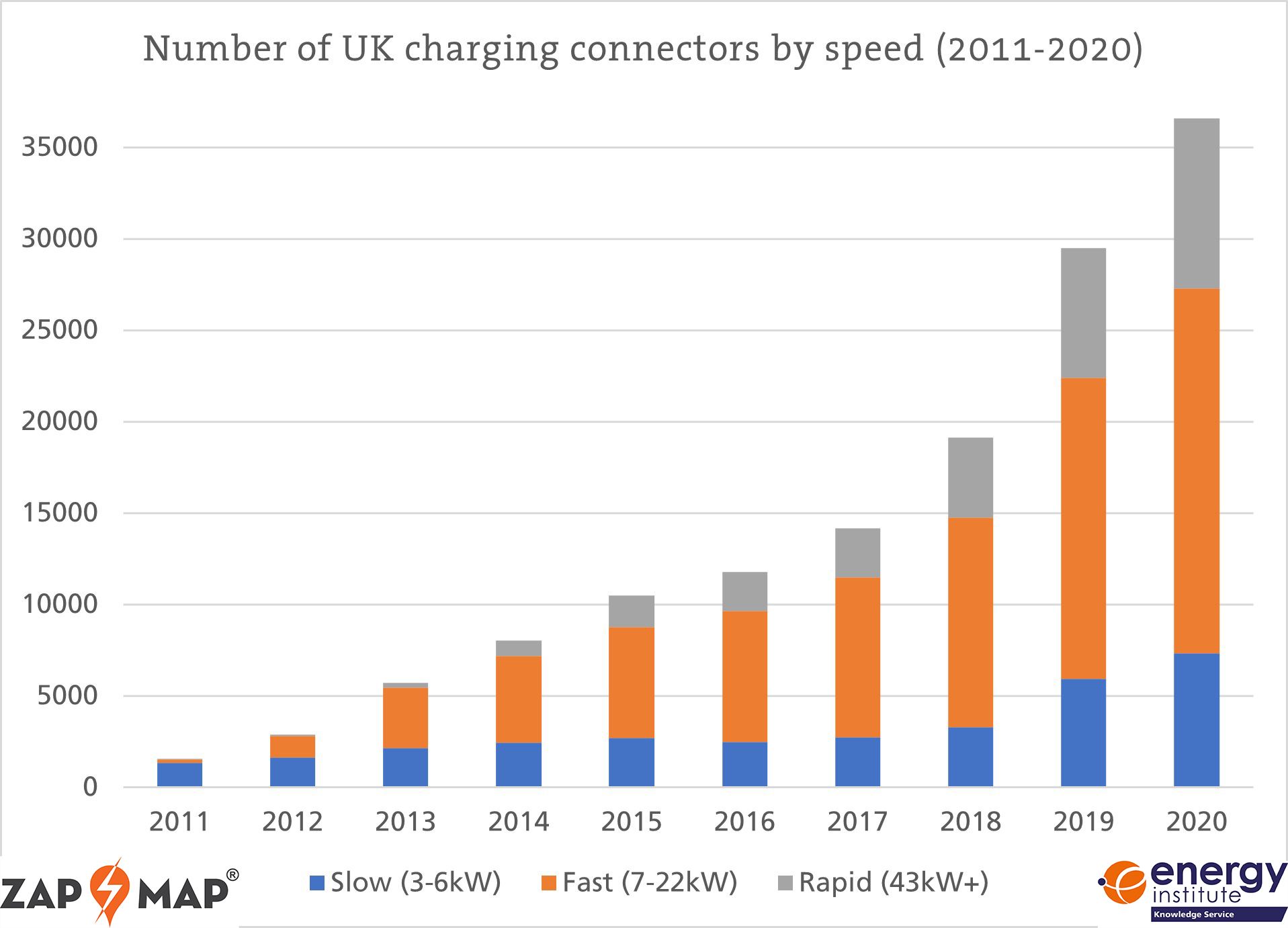

Encouragingly, despite the tough challenges of the pandemic, 2020 saw continued growth in the number of EV charging points installed in the UK.

| |

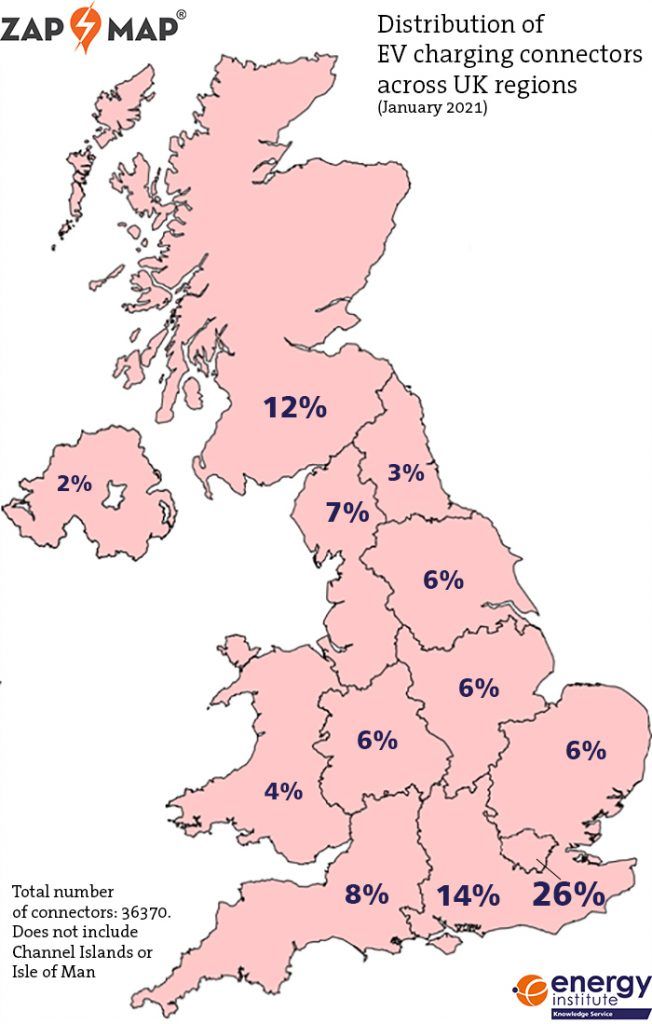

The number of chargers increased by one quarter to total over 36,000. There are now more rapid chargers (43kW+) installed in the UK than there were total EV chargers as recently as 2014.

Rapid chargers are able to charge an EV to 80% in as little as 20 minutes depending on battery capacity; this will help to strengthen overall charging infrastructure by reducing range anxiety and make longer journeys quicker and more convenient for EV drivers.

The number of charging points has increased in every region of the UK since last year, however there is a clear geographical disparity in their location. Greater London contains over one quarter of all EV charging points in the UK, more than the regions of Yorkshire and the Humber, West Midlands, East Midlands, North East and Wales combined. This is a frustrating situation for EV owners who live outside of the capital, although there is some cause for optimism; proportionally the Midlands and Wales have seen the biggest growth, with the number of charging points more than doubling in these regions since 2018.

ICE vehicles have played a huge role in peoples’ lives in the UK for more than a century and it must be recognised that switching to an EV represents a significant change for drivers. However, EVs are beginning to match up to ICE vehicles in terms of range, costs and reliability, and they also bring to the table the added benefits of being cleaner, quieter and more environmentally-friendly. At present, Government support is crucial to overcoming the ‘chicken and egg’ problem – EV uptake is driven in part by charging infrastructure, but building new infrastructure is unpopular when the market for it is small. As EVs become fully mainstream and command a larger market share, this feedback loop should become positive; costs will come down, and the road fuel sector will be encouraged to improve charging infrastructure for a growing number of users.

To find out more, the Energy Institute’s 2021 Retail Marketing Survey is available as part of its Road Fuels collection. You can find not only the UK fuel retail marketing statistics published since 1971, but also additional information covering the road fuels sector, from training courses to technical guidance.

Images courtesy of Energy Institute.