Calls for evidence have been requested from the Transport Committee for its inquiry into zero emissions transport and road pricing.

In this new inquiry, parliament’s Transport Committee will consider the implications of accelerating the shift to zero emission vehicles, including bus and freight vehicles, and the case for using innovative new technology to introduce some form of road pricing.

The Committee invites written evidence on the following terms of reference by 17 February, 2021.

Accelerating the shift to zero emission vehicles

- The feasibility, opportunities, and challenges presented by the acceleration of the ban of the sale of new petrol and diesel vehicles to 2030;

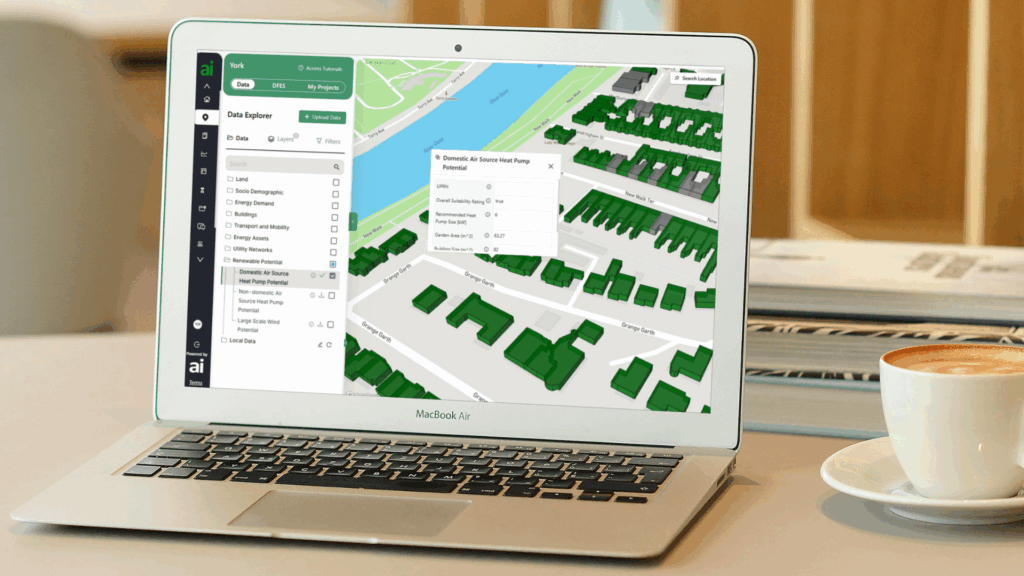

- The actions required by Government and private operators to encourage greater uptake of electric vehicles and the infrastructure required to support them;

- The particular challenges around decarbonising buses and how these should be addressed;

- The Government’s ambition to phase out the sale of new diesel heavy goods vehicles, including the scope to use hydrogen as an alternative fuel.

Road pricing

- The case for introducing some form of road pricing and the economic, fiscal, environmental and social impacts of doing so;

- Which particular road pricing or pay-as-you-drive schemes would be most appropriate for the UK context and the practicalities of implementing such schemes;

- The level of public support for road pricing and how the views of the public need to be considered in the development of any road pricing scheme;

- The lessons to be learned from other countries who are seeking to decarbonise road transport and/or utilise forms of road pricing.

To support the transition to electric vehicles, ministers have committed up to £1 billion to support the electrification of UK vehicles and their supply chains. A further £1.3bn has been committed to accelerate the roll out of charging infrastructure and installing more on-street chargers near homes and workplaces.

Meanwhile, the £40 billion annual income from Fuel Duty and Vehicle Excise Duty is likely to decline sharply. The Government has said the tax system will need to encourage the update of electric vehicles and that revenue from motoring taxes will need to keep pace with the changes. One potential solution is the introduction of road pricing or pay-as-you-drive schemes which has previously been perceived to lack public support.

Chair of the Transport Committee, Huw Merriman MP, said: “The Government decision to bring forward the ban on the sale of new petrol, hybrid and diesel cars, recently announced in the ‘Ten Point Plan’ for a green industrial revolution, is considered a vital step along the UK’s path to net zero. This inquiry will help us get into the details and practicalities of the policy and the financial implications.

“A consequence of the transition to electric vehicles is a potential £40 billion annual fiscal black hole, due to the reduction in Fuel Duty and Vehicle Excise Duty. Something will have to change. We will be exploring whether radical road pricing or ‘pay-as-you-drive’ schemes can offer a revenue-raising solution to this problem. We will explore the practicalities of different schemes, the level of public support for them, and best practice from other countries. We will also assess whether new technologies and pricing can both be utilised to incentivise consumer behaviour change, reduce congestion and promote active travel.”